General Information

| Situs Address | 5420 S 99 AV E TULSA 74146 |

|---|---|

| Owner Name |

BLUEWATER INVESTMENTS LLC C/O MICHAEL S HOPPER

|

| Owner Mailing Address | PO BOX 511 DISNEY , OK 743400511 |

| Account Type | Commercial |

| Parcel ID | 77505-94-31-44660 |

| Land Area | 1.04 acres / 45,498 sq ft |

| School District | T-9A |

| Legal Description | Subdivision: TULSA SOUTHEAST IND DIST B5A-8 RESUB PRT BLK A TUL SE EXT (77505) Legal: LT 7 BLK 5A Section: 31 Township: 19 Range: 14 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

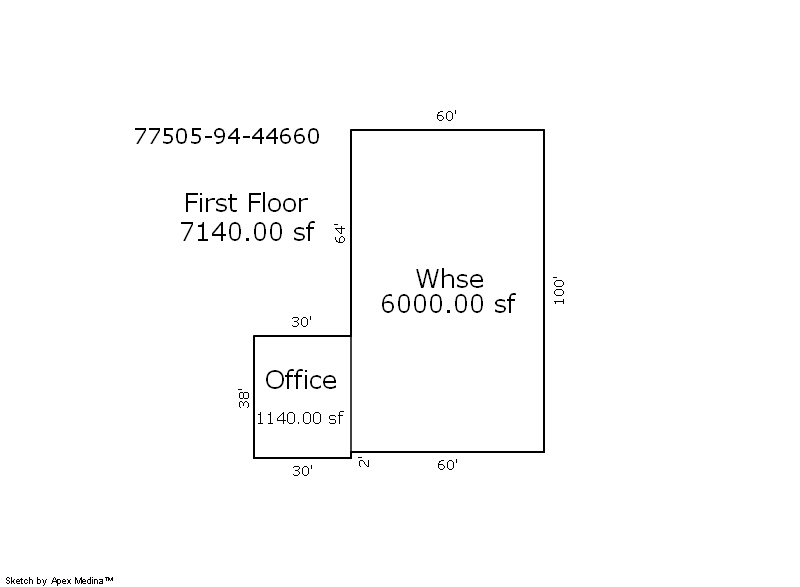

| 2025 | 1974 | Commercial | 7,140 sqft | 1.00 | 17 | 0.00 | |

| 1.00 | Storage Warehouse | Space Heater | |||||

| 2025 | 1978 | Commercial | 8,040 sqft | 1.00 | 18 | 0.00 | |

| 2.00 | Distribution Warehouse | Space Heater | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1974 | Commercial | 7,140 sqft | 1.00 | 17 | 0.00 | |

| 1.00 | Storage Warehouse | Space Heater | |||||

| 2024 | 1978 | Commercial | 8,040 sqft | 1.00 | 18 | 0.00 | |

| 2.00 | Distribution Warehouse | Space Heater | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1974 | Commercial | 7,140 sqft | 1.00 | 17 | 0.00 | |

| 1.00 | Storage Warehouse | Space Heater | |||||

| 2023 | 1978 | Commercial | 8,040 sqft | 1.00 | 18 | 0.00 | |

| 2.00 | Distribution Warehouse | Space Heater | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $819,700 | $819,700 | - |

| Total Taxable Value (Capped) | $489,485 | $513,960 | - |

| Improvement Value | $683,200 | $683,200 | - |

| Land Value | $136,500 | $136,500 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $53,843 | $56,536 | - |

| Exemptions | $0 | $0 | - |

| Net Assessed Value | $53,843 | $56,536 | - |

| School District | T-9A | ||

| Tax Rate | 127.87 | 131.23 | 131.23 |

| Estimated taxes | $6,885 | $7,419 | - |

| Last Notice Date | 1/30/2024 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 7/17/1997 | FRANK PAXTON CO ROY JACKS | BLUEWATER INVESTMENTS LLC | $385,000 | History | 2000230043 BK-05936PG-01002 |

Sales/Documents

| Sale Date | 7/17/1997 |

|---|---|

| Grantor | FRANK PAXTON CO ROY JACKS |

| Grantee | BLUEWATER INVESTMENTS LLC |

| Sale Price | $385,000 |

| Deed Type | History |

| Document Number | 2000230043 BK-05936PG-01002 |