General Information

| Situs Address | 7409 S IRONWOOD AV W BROKEN ARROW 74011 |

|---|---|

| Owner Name |

CLAUNCH, JUSTIN R AND DESTINY A

|

| Owner Mailing Address | 7409 S IRONWOOD AVE BROKEN ARROW , OK 74012 |

| Account Type | Residential |

| Parcel ID | 79825-74-03-11970 |

| Land Area | 0.20 acres / 8,625 sq ft |

| School District | BA-3A |

| Legal Description | Subdivision: INDIAN SPRINGS PARK II (79825) Legal: LT 17 BLK 6 Section: 03 Township: 17 Range: 14 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

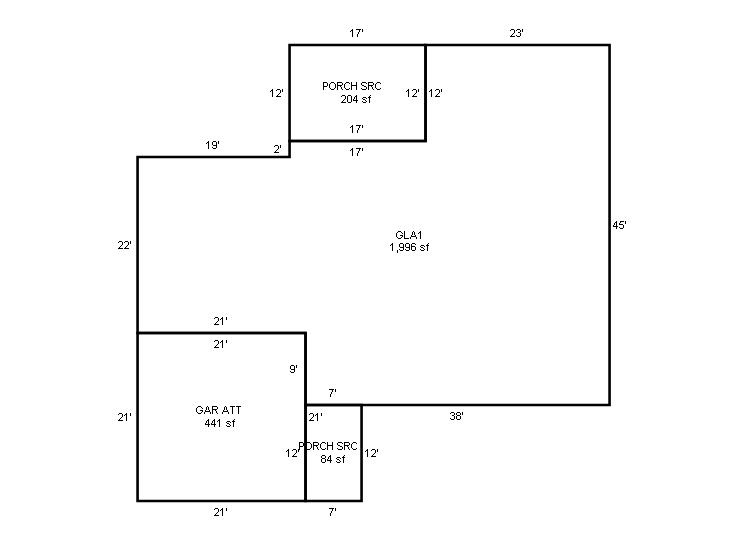

| 2025 | 1980 | Residential | 1,996 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Masonry Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1980 | Residential | 1,996 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | FrameSiding/MasonryVeneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1980 | Residential | 1,996 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | FrameSiding/MasonryVeneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $215,481 | $231,201 | $233,600 |

| Total Taxable Value (Capped) | $153,529 | $158,135 | $162,879 |

| Improvement Value | $181,952 | $197,672 | $200,071 |

| Land Value | $33,529 | $33,529 | $33,529 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $16,888 | $17,395 | $17,917 |

| Exemptions | -$1,000 | -$1,000 | -$1,000 |

| Net Assessed Value | $15,888 | $16,395 | $16,917 |

| School District | BA-3A | ||

| Tax Rate | 128.50 | 128.81 | 128.81 |

| Estimated taxes | $2,042 | $2,112 | $2,179 |

| Last Notice Date | 2/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | |||

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 1/1/2002 | $105,000 | General Warranty Deed | 2000247044 BK-06685PG-01693 | ||

| 3/1/1989 | $78,000 | History | 2000247045 BK-05171PG-00181 | ||

| 12/1/1986 | $72,000 | History | 2000247046 BK-04987PG-03093 |

Sales/Documents

| Sale Date | 1/1/2002 |

|---|---|

| Grantor | |

| Grantee | |

| Sale Price | $105,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2000247044 BK-06685PG-01693 |

| Sale Date | 3/1/1989 |

| Grantor | |

| Grantee | |

| Sale Price | $78,000 |

| Deed Type | History |

| Document Number | 2000247045 BK-05171PG-00181 |

| Sale Date | 12/1/1986 |

| Grantor | |

| Grantee | |

| Sale Price | $72,000 |

| Deed Type | History |

| Document Number | 2000247046 BK-04987PG-03093 |