R80857943464690

806 W INDIANAPOLIS PL N BROKEN ARROW 74012

$381,700

$27,054

General Information

| Situs Address | 806 W INDIANAPOLIS PL N BROKEN ARROW 74012 |

|---|---|

| Owner Name |

SIX, SCOTT R

|

| Owner Mailing Address | 806 W INDIANAPOLIS PL BROKEN ARROW , OK 740120762 |

| Account Type | Residential |

| Parcel ID | 80857-94-34-64690 |

| Land Area | 0.34 acres / 14,767 sq ft |

| School District | BA-3A |

| Legal Description | Subdivision: RESERVE AT BATTLE CREEK, THE PRT RSB PRT GREEN COUNTRY VILLAS (80857) Legal: LT 13 BLK 4 Section: 34 Township: 19 Range: 14 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

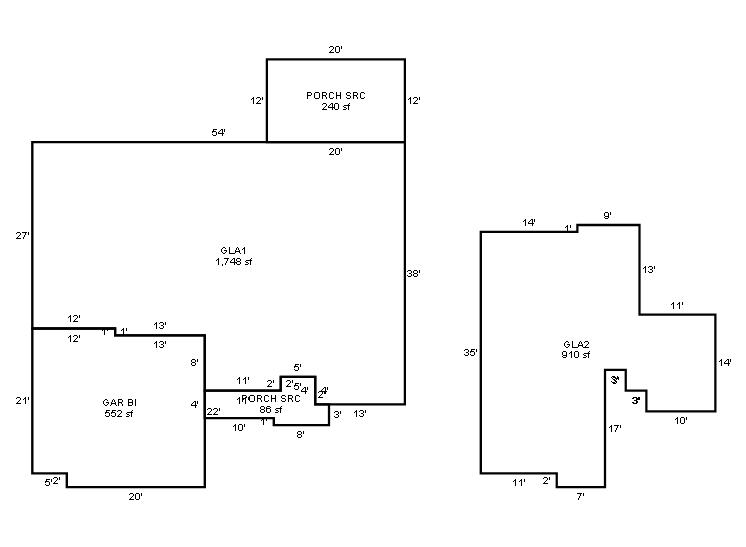

| 2025 | 2003 | Residential | 2,658 sqft | 1.50 | 8 | 3.00 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2003 | Residential | 2,658 sqft | 1.50 | 8 | 3.00 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2003 | Residential | 2,658 sqft | 1.50 | 8 | 3.00 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $366,714 | $353,760 | $381,700 |

| Total Taxable Value (Capped) | $240,400 | $247,612 | $255,040 |

| Improvement Value | $323,514 | $310,560 | $338,500 |

| Land Value | $43,200 | $43,200 | $43,200 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $26,444 | $27,237 | $28,054 |

| Exemptions | -$1,000 | -$1,000 | -$1,000 |

| Net Assessed Value | $25,444 | $26,237 | $27,054 |

| School District | BA-3A | ||

| Tax Rate | 128.50 | 128.81 | 128.81 |

| Estimated taxes | $3,270 | $3,380 | $3,485 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | |||

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 12/20/2023 | SIX, DIANE L | SIX, SCOTT R | $0 | Quit Claim Deed | 2024010210 |

| 3/30/2017 | SIX, DIANE L | SIX, SCOTT R | $0 | Divorce Decree | 2023102204 |

| 1/1/2007 | WARREN, MARK B, TRUSTEE | SIX, SCOTT R | $220,000 | General Warranty Deed | 2007007977 |

| 9/1/2003 | $190,000 | History | 2000251155 BK-07134PG-01087 |

Sales/Documents

| Sale Date | 12/20/2023 |

|---|---|

| Grantor | SIX, DIANE L |

| Grantee | SIX, SCOTT R |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2024010210 |

| Sale Date | 3/30/2017 |

| Grantor | SIX, DIANE L |

| Grantee | SIX, SCOTT R |

| Sale Price | $0 |

| Deed Type | Divorce Decree |

| Document Number | 2023102204 |

| Sale Date | 1/1/2007 |

| Grantor | WARREN, MARK B, TRUSTEE |

| Grantee | SIX, SCOTT R |

| Sale Price | $220,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2007007977 |

| Sale Date | 9/1/2003 |

| Grantor | |

| Grantee | |

| Sale Price | $190,000 |

| Deed Type | History |

| Document Number | 2000251155 BK-07134PG-01087 |