General Information

| Situs Address | 6600 S 5 AV E BROKEN ARROW 740117221 |

|---|---|

| Owner Name |

BUTCHER, STEVEN II

|

| Owner Mailing Address | 6600 S 5TH ST BROKEN ARROW , OK 740117221 |

| Account Type | Residential |

| Parcel ID | 80955-74-02-11680 |

| Land Area | 0.37 acres / 16,200 sq ft |

| School District | BA-3A |

| Legal Description | Subdivision: SADDLEBACK (80955) Legal: LT 3 BLK 2 Section: 02 Township: 17 Range: 14 |

| Zoning | View INCOG's Zoning Data |

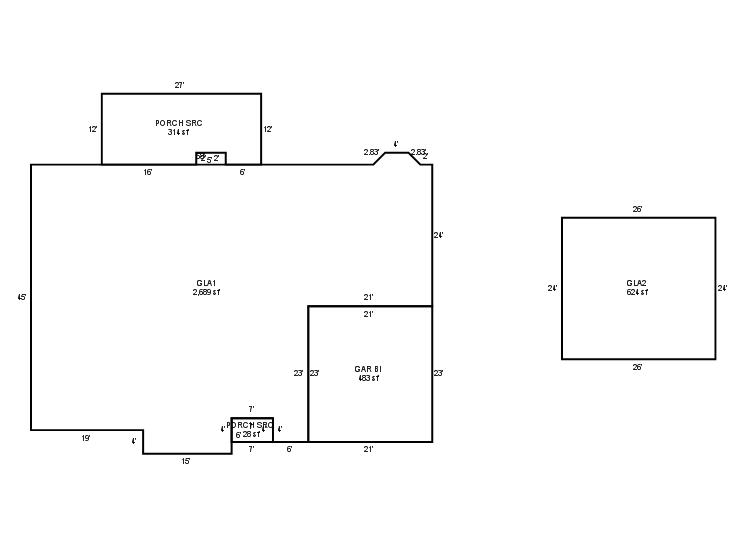

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 1980 | Residential | 3,313 sqft | 1.50 | 8 | 2.10 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | FrameSiding/MasonryVeneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1980 | Residential | 3,313 sqft | 1.50 | 8 | 2.10 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | FrameSiding/MasonryVeneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1980 | Residential | 3,313 sqft | 1.50 | 8 | 2.10 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | FrameSiding/MasonryVeneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $416,824 | $400,956 | $429,100 |

| Total Taxable Value (Capped) | $248,830 | $256,295 | $263,983 |

| Improvement Value | $378,753 | $362,885 | $391,029 |

| Land Value | $38,071 | $38,071 | $38,071 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $27,371 | $28,193 | $29,038 |

| Exemptions | -$1,000 | -$1,000 | -$1,000 |

| Net Assessed Value | $26,371 | $27,193 | $28,038 |

| School District | BA-3A | ||

| Tax Rate | 128.50 | 128.81 | 128.81 |

| Estimated taxes | $3,389 | $3,503 | $3,612 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | |||

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 7/20/2016 | WILSON, RITA S | BUTCHER, STEVEN II | $218,000 | Warranty Deed | 2016068597 |

| 7/20/2016 | WILSON, LARRY W | WILSON, RITA S | $0 | Affidavit Of Surviving Joint Tenant | 2016068596 |

| 1/18/1984 | WALSH, WILLIAM G JR TTEE | WILSON, LARRY W & RITA S | $135,000 | Warranty Deed | 1984235182 |

Sales/Documents

| Sale Date | 7/20/2016 |

|---|---|

| Grantor | WILSON, RITA S |

| Grantee | BUTCHER, STEVEN II |

| Sale Price | $218,000 |

| Deed Type | Warranty Deed |

| Document Number | 2016068597 |

| Sale Date | 7/20/2016 |

| Grantor | WILSON, LARRY W |

| Grantee | WILSON, RITA S |

| Sale Price | $0 |

| Deed Type | Affidavit Of Surviving Joint Tenant |

| Document Number | 2016068596 |

| Sale Date | 1/18/1984 |

| Grantor | WALSH, WILLIAM G JR TTEE |

| Grantee | WILSON, LARRY W & RITA S |

| Sale Price | $135,000 |

| Deed Type | Warranty Deed |

| Document Number | 1984235182 |