General Information

| Situs Address | 14273 S GLEN ST E GLENPOOL 74033 |

|---|---|

| Owner Name |

JOHNSON, RAE DEAN AND KARLA DEANE

|

| Owner Mailing Address | 14273 S GLEN ST GLENPOOL , OK 74033 |

| Account Type | Residential |

| Parcel ID | 85250-72-14-09670 |

| Land Area | 0.19 acres / 8,250 sq ft |

| School District | GL-13A |

| Legal Description | Subdivision: PEPPER TREE (85250) Legal: S27.5 LT 20 & ALL LT 21 BLK 1 Section: 14 Township: 17 Range: 12 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

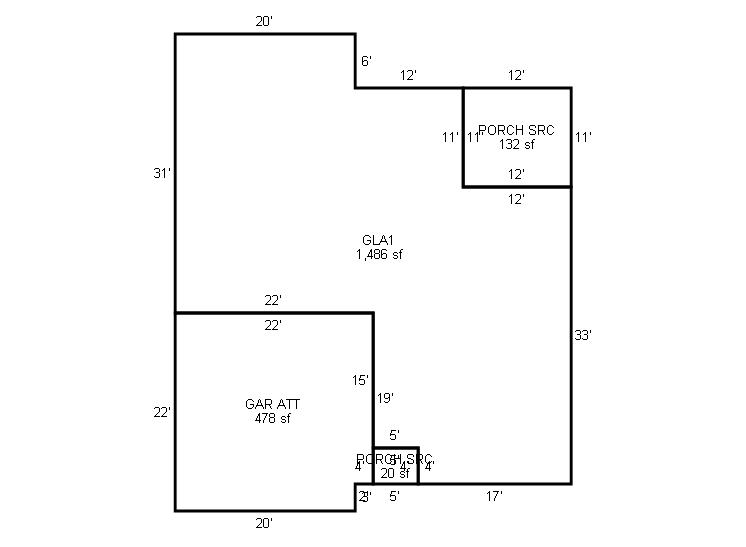

| 2025 | 1996 | Residential | 1,486 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Masonry Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1996 | Residential | 1,486 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Masonry Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1996 | Residential | 1,486 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Masonry Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $196,995 | $183,565 | $224,900 |

| Total Taxable Value (Capped) | $131,909 | $135,866 | $139,942 |

| Improvement Value | $176,504 | $163,074 | $204,409 |

| Land Value | $20,491 | $20,491 | $20,491 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $14,510 | $14,945 | $15,394 |

| Exemptions | -$1,000 | -$1,000 | -$1,000 |

| Net Assessed Value | $13,510 | $13,945 | $14,394 |

| School District | GL-13A | ||

| Tax Rate | 117.07 | 120.02 | 120.02 |

| Estimated taxes | $1,582 | $1,674 | $1,728 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | |||

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 11/1/1996 | $3,000 | History | 2000283578 BK-05863PG-00638 | ||

| 9/1/1996 | $77,000 | Warranty Deed | 2000283579 BK-05844PG-00255 | ||

| 5/1/1996 | $4,500 | History | 2000283580 BK-05805PG-01818 |

Sales/Documents

| Sale Date | 11/1/1996 |

|---|---|

| Grantor | |

| Grantee | |

| Sale Price | $3,000 |

| Deed Type | History |

| Document Number | 2000283578 BK-05863PG-00638 |

| Sale Date | 9/1/1996 |

| Grantor | |

| Grantee | |

| Sale Price | $77,000 |

| Deed Type | Warranty Deed |

| Document Number | 2000283579 BK-05844PG-00255 |

| Sale Date | 5/1/1996 |

| Grantor | |

| Grantee | |

| Sale Price | $4,500 |

| Deed Type | History |

| Document Number | 2000283580 BK-05805PG-01818 |