General Information

| Situs Address | 3838 E PARK RD N TULSA 74115 |

|---|---|

| Owner Name |

MATHEOS FAMILY TRUST

|

| Owner Mailing Address | 1500 S FRISCO AVE APT 8D TULSA , OK 741193837 |

| Account Type | Residential |

| Parcel ID | 90315-03-15-54080 |

| Land Area | 2.50 acres / 108,900 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: UNPLATTED (90315) Legal: SE SE NW SW SEC 15 20 13 Section: 15 Township: 20 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

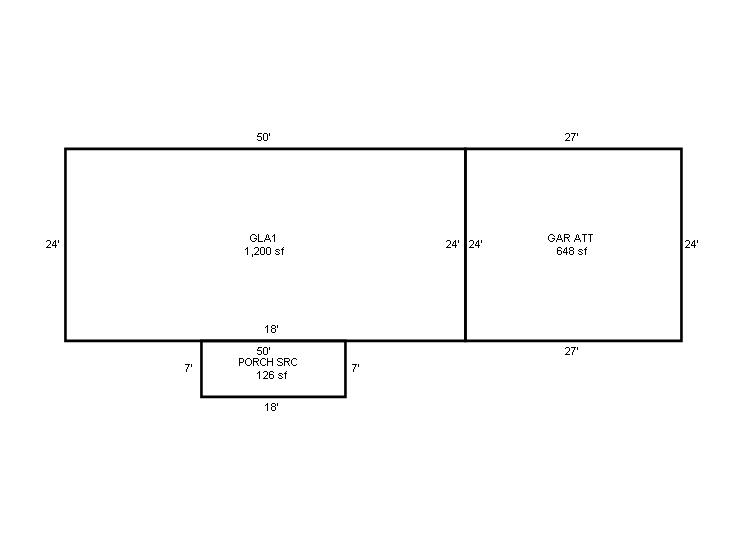

| 2025 | 1945 | Residential | 1,200 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1945 | Residential | 1,200 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1945 | Residential | 1,200 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $50,000 | $50,000 | - |

| Total Taxable Value (Capped) | $50,000 | $50,000 | - |

| Improvement Value | $40,000 | $40,000 | - |

| Land Value | $10,000 | $10,000 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $5,500 | $5,500 | - |

| Exemptions | $0 | $0 | - |

| Net Assessed Value | $5,500 | $5,500 | - |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $698 | $712 | - |

| Last Notice Date | There is no recent notice date for this property | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 4/28/2017 | CADION, JERRY WAYNE & ELAINE B TR &STEPH, RICHARD DICKIARA & PAM DICKIARA-HEINTZ | MATHEOS FAMILY TRUST | $50,000 | General Warranty Deed | 2017040572 |

| 10/13/2015 | LADONNA CADION DICKIARA ESTATE | STEPHEN RICHARD DICKIARA & PAM DICKIARA-HEINTZ | $0 | Journal Entry Of Judgment | 2015092533 |

| 8/18/2015 | CADION, OLLIE A LF ESTATE | CADION, JERRY WAYNE & LADONNA CADION DICKIARA | $0 | Decree Of Distribution | 2015077672 |

| 6/12/2014 | CADION, JERRY WAYNE | CADION, JERRY W & ELAINE B REV TRUST | $0 | Quit Claim Deed | 2014050803 |

| 7/26/1977 | $0 | General Warranty Deed | 2000287286 BK-04275PG-01549 |

Sales/Documents

| Sale Date | 4/28/2017 |

|---|---|

| Grantor | CADION, JERRY WAYNE & ELAINE B TR &STEPH, RICHARD DICKIARA & PAM DICKIARA-HEINTZ |

| Grantee | MATHEOS FAMILY TRUST |

| Sale Price | $50,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2017040572 |

| Sale Date | 10/13/2015 |

| Grantor | LADONNA CADION DICKIARA ESTATE |

| Grantee | STEPHEN RICHARD DICKIARA & PAM DICKIARA-HEINTZ |

| Sale Price | $0 |

| Deed Type | Journal Entry Of Judgment |

| Document Number | 2015092533 |

| Sale Date | 8/18/2015 |

| Grantor | CADION, OLLIE A LF ESTATE |

| Grantee | CADION, JERRY WAYNE & LADONNA CADION DICKIARA |

| Sale Price | $0 |

| Deed Type | Decree Of Distribution |

| Document Number | 2015077672 |

| Sale Date | 6/12/2014 |

| Grantor | CADION, JERRY WAYNE |

| Grantee | CADION, JERRY W & ELAINE B REV TRUST |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2014050803 |

| Sale Date | 7/26/1977 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | General Warranty Deed |

| Document Number | 2000287286 BK-04275PG-01549 |