General Information

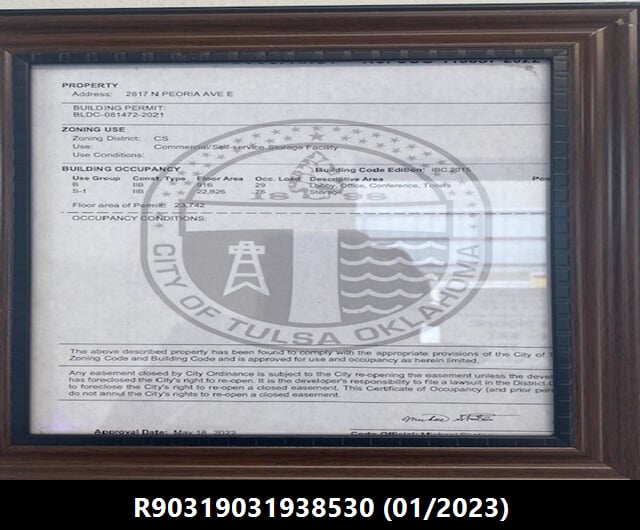

| Situs Address | 2817 N PEORIA AV TULSA 74106 |

|---|---|

| Owner Name |

2817 TULSA STORAGE LLC

|

| Owner Mailing Address | 535 N CHURCH ST STE 105 WEST CHESTER , PA 193802338 |

| Account Type | Commercial |

| Parcel ID | 90319-03-19-38530 |

| Land Area | 11.42 acres / 497,653 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: UNPLATTED (90319) Legal: PRT GOV LT 3 OR NW SW BEG 1319.73S & 100E NWC GOV LT 3 TH N527.32 E10 E1057.18 S527.27 W1067.73 POB LESS BEG 1228.54S & 100E NWC GOV LT 3 TH N186 E235 S186 W235 POB & LESS S25 E857.12 THEREOF SEC 19 20 13 11.425ACS Section: 19 Township: 20 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

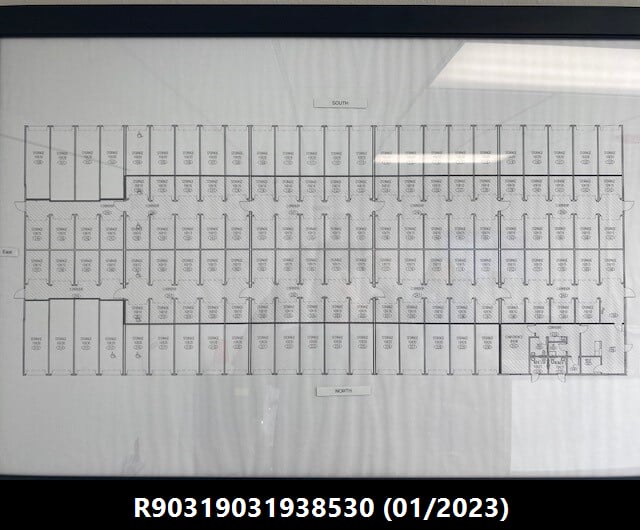

| 2025 | 2022 | Commercial | 24,000 sqft | 1.00 | 9 | 0 | |

| 1.00 | Mini Warehouse | Lap Siding | Complete HVAC | ||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2022 | Commercial | 24,000 sqft | 1.00 | 9 | 0 | |

| 1.00 | Mini Warehouse | Lap Siding | Complete HVAC | ||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2022 | Commercial | 24,000 sqft | 1.00 | 9 | 0 | |

| 1.00 | Mini Warehouse | Lap Siding | Complete HVAC | ||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $2,052,100 | $2,186,400 | $2,700,000 |

| Total Taxable Value (Capped) | $1,974,400 | $2,073,120 | $2,700,000 |

| Improvement Value | $1,554,400 | $1,688,700 | $2,202,300 |

| Land Value | $497,700 | $497,700 | $497,700 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $217,184 | $228,044 | $297,000 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $217,184 | $228,044 | $297,000 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $27,563 | $29,534 | $38,464 |

| Last Notice Date | 3/25/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 1/24/2024 | ZEBRA DEVELOPMENT LLC | 2817 TULSA STORAGE LLC | $2,700,000 | Special Warranty Deed | 2024006500 |

| 2/23/2018 | NORTHWESTERN RIDING CLUB | ZEBRA DEVELOPMENT LLC | $400,000 | General Warranty Deed | 2018016411 |

| 6/24/2011 | NORTHWESTERN RIDING CLUB | NORTHWESTERN RIDING CLUB | $0 | Special Warranty Deed | 2011055418 |

| 6/19/1978 | $0 | History | 2000287554 BK-04335PG-00870 |

Sales/Documents

| Sale Date | 1/24/2024 |

|---|---|

| Grantor | ZEBRA DEVELOPMENT LLC |

| Grantee | 2817 TULSA STORAGE LLC |

| Sale Price | $2,700,000 |

| Deed Type | Special Warranty Deed |

| Document Number | 2024006500 |

| Sale Date | 2/23/2018 |

| Grantor | NORTHWESTERN RIDING CLUB |

| Grantee | ZEBRA DEVELOPMENT LLC |

| Sale Price | $400,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2018016411 |

| Sale Date | 6/24/2011 |

| Grantor | NORTHWESTERN RIDING CLUB |

| Grantee | NORTHWESTERN RIDING CLUB |

| Sale Price | $0 |

| Deed Type | Special Warranty Deed |

| Document Number | 2011055418 |

| Sale Date | 6/19/1978 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | History |

| Document Number | 2000287554 BK-04335PG-00870 |