General Information

| Situs Address | 2931 E APACHE ST N TULSA 74110 |

|---|---|

| Owner Name |

APACHE PROPERTIES LLC

|

| Owner Mailing Address | 5927 S LOUISVILLE PL TULSA , OK 741357810 |

| Account Type | Commercial |

| Parcel ID | 90320-03-20-44730 |

| Land Area | 7.50 acres / 326,631 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: UNPLATTED (90320) Legal: BEG 50N SECR E/2 SW SE TH W208.32 N248 W244.08 N599.19 E72.08 N53.53 E247.44 S124.15 E132.68 S777.04 POB SEC 20 20 13 7.498ACS Section: 20 Township: 20 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

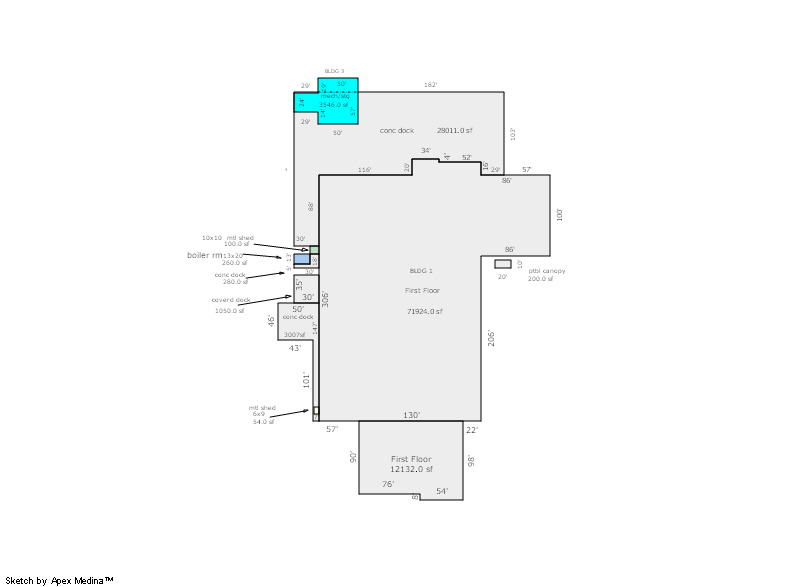

| 2025 | 1965 | Commercial | 71,924 sqft | 1.00 | 18 | 0.00 | |

| 1.00 | Indust Lght Manufacturing | Warm and Cool Air Zone | |||||

| 2025 | 1965 | Commercial | 12,132 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Office Building | Warm and Cool Air Zone | |||||

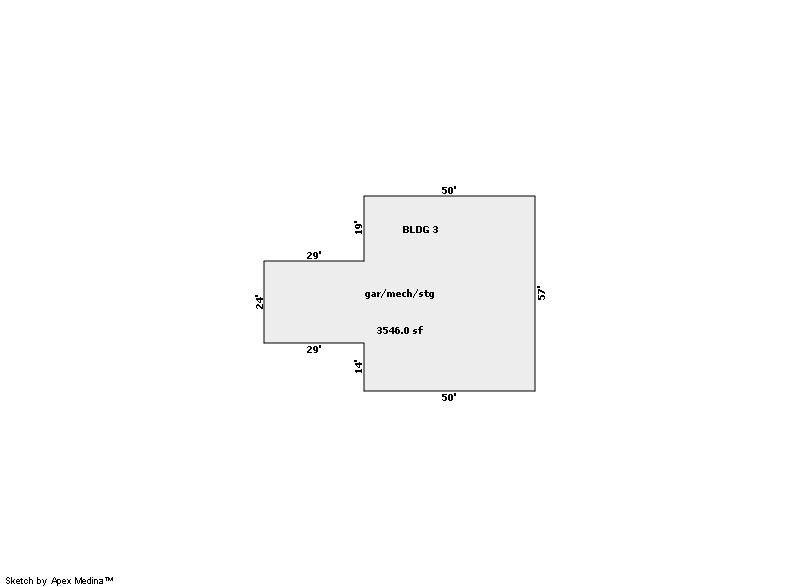

| 2025 | 1965 | Commercial | 3,546 sqft | 1.00 | 12 | 0.00 | |

| 2.00 | Storage Warehouse | Space Heater | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1965 | Commercial | 12,132 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Office Building | Warm and Cool Air Zone | |||||

| 2024 | 1965 | Commercial | 71,924 sqft | 1.00 | 18 | 0.00 | |

| 1.00 | Indust Lght Manufacturing | Warm and Cool Air Zone | |||||

| 2024 | 1965 | Commercial | 3,546 sqft | 1.00 | 12 | 0.00 | |

| 2.00 | Storage Warehouse | Space Heater | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1965 | Commercial | 71,924 sqft | 1.00 | 18 | 0.00 | |

| 1.00 | Indust Lght Manufacturing | Warm and Cool Air Zone | |||||

| 2023 | 1965 | Commercial | 12,132 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Office Building | Warm and Cool Air Zone | |||||

| 2023 | 1965 | Commercial | 3,546 sqft | 1.00 | 12 | 0.00 | |

| 2.00 | Storage Warehouse | Space Heater | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $3,518,300 | $3,729,000 | $3,523,800 |

| Total Taxable Value (Capped) | $1,124,426 | $1,180,647 | $1,239,680 |

| Improvement Value | $3,256,600 | $3,467,300 | $3,262,100 |

| Land Value | $261,700 | $261,700 | $261,700 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $123,687 | $129,871 | $136,364 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $123,687 | $129,871 | $136,364 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $15,697 | $16,820 | $17,661 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 12/15/2016 | APACHE PROPERTIES LLC | APACHE PROPERTIES LLC | $0 | Special Warranty Deed | 2016118691 |

| 12/15/1998 | $0 | Special Warranty Deed | 2000287680 BK-06148PG-00982 | ||

| 11/20/1997 | FACET INTERNATIONAL INC DOUGLA | DOLPHIN STRATEGIES INC | $1,400,000 | General Warranty Deed | 1997200189 |

Sales/Documents

| Sale Date | 12/15/2016 |

|---|---|

| Grantor | APACHE PROPERTIES LLC |

| Grantee | APACHE PROPERTIES LLC |

| Sale Price | $0 |

| Deed Type | Special Warranty Deed |

| Document Number | 2016118691 |

| Sale Date | 12/15/1998 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | Special Warranty Deed |

| Document Number | 2000287680 BK-06148PG-00982 |

| Sale Date | 11/20/1997 |

| Grantor | FACET INTERNATIONAL INC DOUGLA |

| Grantee | DOLPHIN STRATEGIES INC |

| Sale Price | $1,400,000 |

| Deed Type | General Warranty Deed |

| Document Number | 1997200189 |