General Information

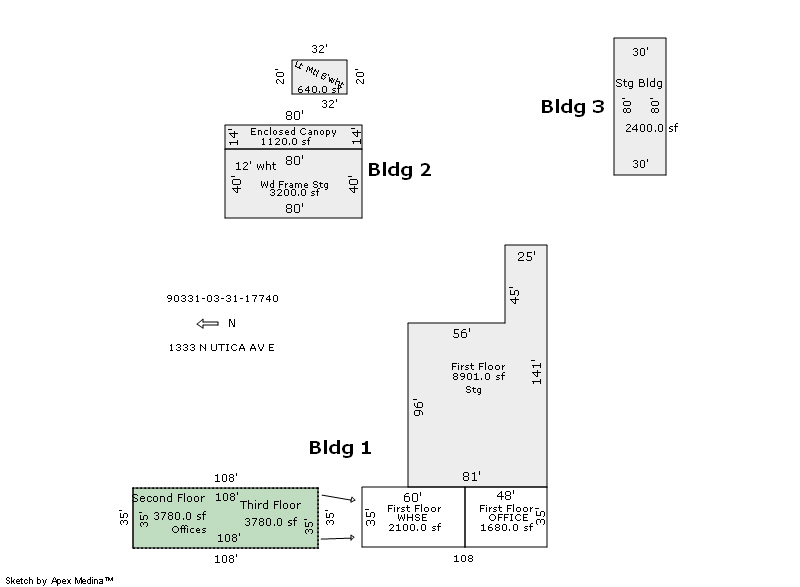

| Situs Address | 1333 N UTICA AV E TULSA 74110 |

|---|---|

| Owner Name |

THUMPER PROPERTIES LLC

|

| Owner Mailing Address | 22705 S ROCKY LN CLAREMORE , OK 74017 |

| Account Type | Commercial |

| Parcel ID | 90331-03-31-17740 |

| Land Area | 5.00 acres / 217,800 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: UNPLATTED (90331) Legal: N/2 SW NW NE SEC 31 20 13 Section: 31 Township: 20 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 1950 | Commercial | 11,340 sqft | 3.00 | 10 | 0.00 | |

| 1.00 | Office Building | Package Unit | |||||

| 2025 | 1950 | Commercial | 8,901 sqft | 1.00 | 8 | 0.00 | |

| 1.00 | Equipment Storage | None | |||||

| 2025 | 1996 | Commercial | 4,320 sqft | 1.00 | 12 | 0.00 | |

| 2.00 | Storage Warehouse | None | |||||

| 2025 | 1996 | Commercial | 2,400 sqft | 1.00 | 14 | 0.00 | |

| 3.00 | Storage Warehouse | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1950 | Commercial | 11,340 sqft | 3.00 | 10 | 0.00 | |

| 1.00 | Office Building | Package Unit | |||||

| 2024 | 1950 | Commercial | 8,901 sqft | 1.00 | 8 | 0.00 | |

| 1.00 | Equipment Storage | None | |||||

| 2024 | 1996 | Commercial | 4,320 sqft | 1.00 | 12 | 0.00 | |

| 2.00 | Storage Warehouse | None | |||||

| 2024 | 1996 | Commercial | 2,400 sqft | 1.00 | 14 | 0.00 | |

| 3.00 | Storage Warehouse | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1950 | Commercial | 11,340 sqft | 3.00 | 10 | 0.00 | |

| 1.00 | Office Building | Package Unit | |||||

| 2023 | 1950 | Commercial | 8,901 sqft | 1.00 | 8 | 0.00 | |

| 1.00 | Equipment Storage | None | |||||

| 2023 | 1996 | Commercial | 4,320 sqft | 1.00 | 12 | 0.00 | |

| 2.00 | Storage Warehouse | None | |||||

| 2023 | 1996 | Commercial | 2,400 sqft | 1.00 | 14 | 0.00 | |

| 3.00 | Storage Warehouse | None | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $743,600 | $804,100 | $806,600 |

| Total Taxable Value (Capped) | $472,090 | $495,694 | $520,479 |

| Improvement Value | $580,200 | $640,700 | $643,200 |

| Land Value | $163,400 | $163,400 | $163,400 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $51,930 | $54,526 | $57,253 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $51,930 | $54,526 | $57,253 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 134.01 |

| Estimated taxes | $6,590 | $7,062 | $7,672 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 8/7/2008 | WORLD WON DEVELOPMENT | HENDERSON SANDRA R | $575,000 | History | 2008083941 |

| 4/24/2000 | $0 | General Warranty Deed | 2000288194 BK-06354PG-02617 | ||

| 1/2/1996 | OAKLEY SHELBY D & PAMELA | HENDERSON SANDRA R | $385,000 | General Warranty Deed | 1996200008 |

Sales/Documents

| Sale Date | 8/7/2008 |

|---|---|

| Grantor | WORLD WON DEVELOPMENT |

| Grantee | HENDERSON SANDRA R |

| Sale Price | $575,000 |

| Deed Type | History |

| Document Number | 2008083941 |

| Sale Date | 4/24/2000 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | General Warranty Deed |

| Document Number | 2000288194 BK-06354PG-02617 |

| Sale Date | 1/2/1996 |

| Grantor | OAKLEY SHELBY D & PAMELA |

| Grantee | HENDERSON SANDRA R |

| Sale Price | $385,000 |

| Deed Type | General Warranty Deed |

| Document Number | 1996200008 |