General Information

| Situs Address | 998 E 98 ST N SPERRY 74073 |

|---|---|

| Owner Name |

DRISKELL, TOMMY AND ESTHER C/O THOMAS STEVENS

|

| Owner Mailing Address | 11637 N CINCINNATI AVE SKIATOOK , OK 740703577 |

| Account Type | Residential |

| Parcel ID | 91213-12-13-51390 |

| Land Area | 8.29 acres / 361,112 sq ft |

| School District | 8B |

| Legal Description | Subdivision: UNPLATTED (91213) Legal: PRT S/2 SE BEG 1162.04W SECR SE TH W330 N1231.53 ELY ON CRV 223.86 TH S249.03 E123.5 S916.25 POB SEC 13 21 12 8.29AC Section: 13 Township: 21 Range: 12 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

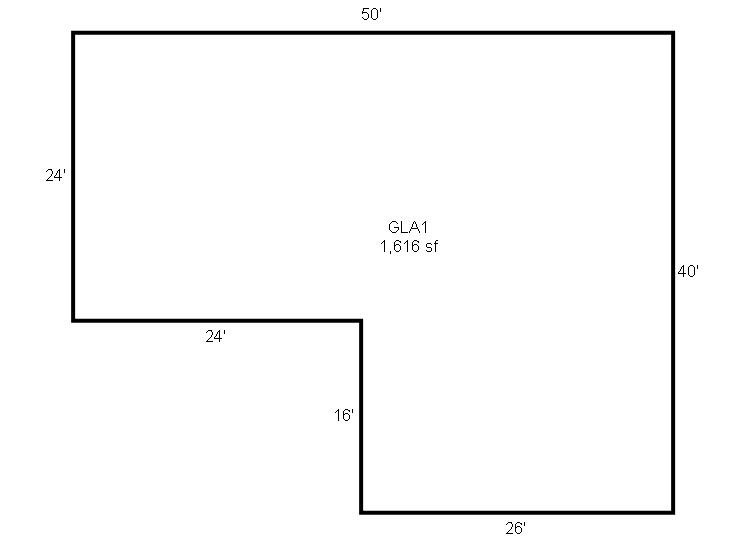

| 2025 | 1955 | Residential | 1,616 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Siding/Stucco Veneer | None | |||

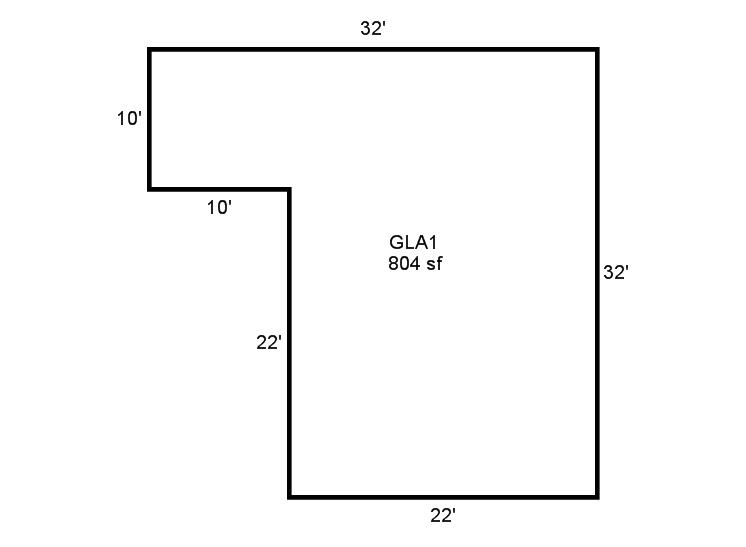

| 2025 | 1955 | Residential | 804 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | Ranch 1 Story | Slab | Frame Siding/Stucco Veneer | None | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1955 | Residential | 1,616 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Siding/Stucco Veneer | None | |||

| 2024 | 1955 | Residential | 804 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | Ranch 1 Story | Slab | Frame Siding/Stucco Veneer | None | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1955 | Residential | 1,616 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Siding/Stucco Veneer | None | |||

| 2023 | 1955 | Residential | 804 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | Ranch 1 Story | Slab | Frame Siding/Stucco Veneer | None | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $80,500 | $80,500 | - |

| Total Taxable Value (Capped) | $74,564 | $78,292 | - |

| Improvement Value | $40,100 | $40,100 | - |

| Land Value | $40,400 | $40,400 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $8,202 | $8,612 | - |

| Exemptions | $0 | $0 | - |

| Net Assessed Value | $8,202 | $8,612 | - |

| School District | 8B | ||

| Tax Rate | 111.14 | 111.47 | 111.47 |

| Estimated taxes | $912 | $960 | - |

| Last Notice Date | 1/30/2024 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| There is no sales information for this account | |||||

Sales/Documents

| There is no sales information for this account |