General Information

| Situs Address | 312 W CHEROKEE ST S SPERRY 74073 |

|---|---|

| Owner Name |

BOYD, JIMMY JR

|

| Owner Mailing Address | 312 W CHEROKEE ST SPERRY , OK 740734252 |

| Account Type | Comm Res |

| Parcel ID | 91223-12-23-00110 |

| Land Area | 21.15 acres / 921,432 sq ft |

| School District | 8B |

| Legal Description | Subdivision: UNPLATTED (91223) Legal: BEG 662.97W NEC NE TH S1321.81 TO SECR W/2 NE NE W662.21 TO SWC W/2 NE NE N322.51 NW251.06 NWLY162.03 E200.03 TO NEC S/2 NW NE N661.25 E662.98 POB SEC 23 21 12 21.153ACS Section: 23 Township: 21 Range: 12 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

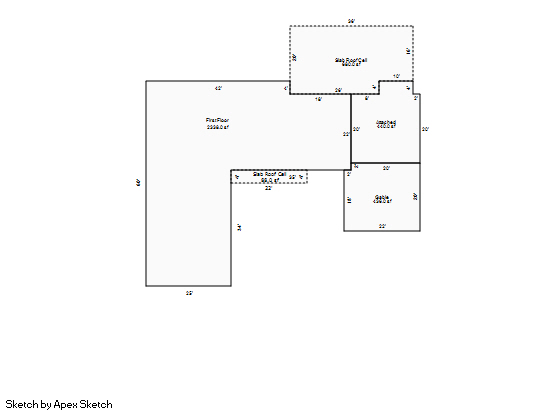

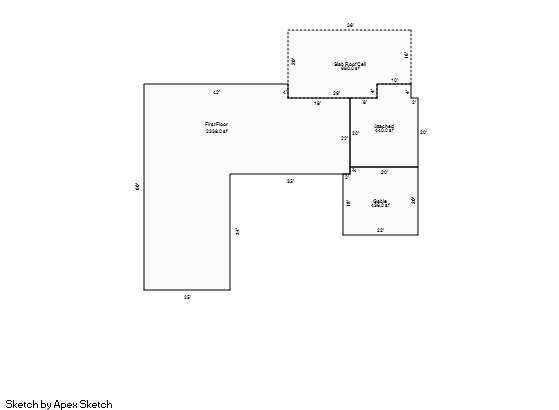

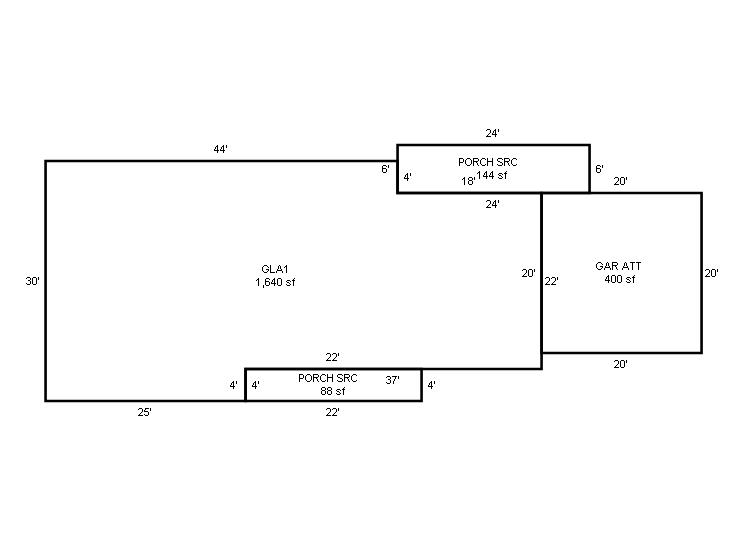

| 2025 | 1954 | Residential | 2,338 sqft | 1.00 | 8 | 1.10 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

| 2025 | 2020 | Commercial | 608 sqft | 1.00 | 8 | 0 | |

| 2.00 | Material Storage Sheds | Package Unit | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1954 | Residential | 2,338 sqft | 1.00 | 8 | 1.10 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

| 2024 | 2020 | Commercial | 608 sqft | 1.00 | 8 | 0 | |

| 2.00 | Material Storage Sheds | Package Unit | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1954 | Residential | 2,338 sqft | 1.00 | 8 | 1.10 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

| 2023 | 2020 | Commercial | 608 sqft | 1.00 | 8 | 0 | |

| 2.00 | Material Storage Sheds | Package Unit | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $201,356 | $214,680 | - |

| Total Taxable Value (Capped) | $185,220 | $194,481 | - |

| Improvement Value | $144,756 | $158,080 | - |

| Land Value | $56,600 | $56,600 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $20,374 | $21,393 | - |

| Exemptions | $0 | $0 | - |

| Net Assessed Value | $20,374 | $21,393 | - |

| School District | 8B | ||

| Tax Rate | 111.14 | 111.47 | 111.47 |

| Estimated taxes | $2,264 | $2,385 | - |

| Last Notice Date | 2/27/2024 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 3/15/2017 | SWARTZ, D F | SWARTZ, MARTHA M | $0 | Affidavit Of Surviving Joint Tenant | 2017025902 |

| 3/15/2017 | SWARTZ, MARTHA M | BOYD, JIMMY JR | $119,000 | General Warranty Deed | 2017025901 |

Sales/Documents

| Sale Date | 3/15/2017 |

|---|---|

| Grantor | SWARTZ, D F |

| Grantee | SWARTZ, MARTHA M |

| Sale Price | $0 |

| Deed Type | Affidavit Of Surviving Joint Tenant |

| Document Number | 2017025902 |

| Sale Date | 3/15/2017 |

| Grantor | SWARTZ, MARTHA M |

| Grantee | BOYD, JIMMY JR |

| Sale Price | $119,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2017025901 |