General Information

| Situs Address | 460 W CHEROKEE ST S SPERRY 74073 |

|---|---|

| Owner Name |

ORNDORFF, TEELA R

|

| Owner Mailing Address | 460 W CHEROKEE ST SPERRY , OK 740734253 |

| Account Type | Residential |

| Parcel ID | 91223-12-23-06865 |

| Land Area | 3.76 acres / 163,732 sq ft |

| School District | SP-8A |

| Legal Description | Subdivision: UNPLATTED (91223) Legal: BEG 645W NEC NW NE TH W105 S210 W105 S49.5 W135 S400.5 E450 N450 W105 N210 POB LESS BEG 990W & 259.5S NEC NW NE THE E135 S400.50 W135 N400.50 POB SEC 23 21 12 3.75ACS Section: 23 Township: 21 Range: 12 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

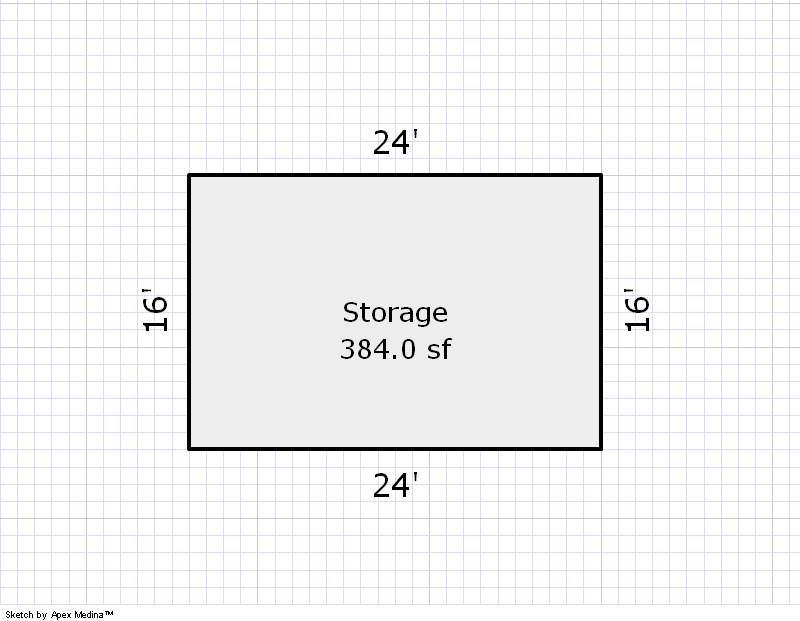

| 2025 | 2009 | Out Building | 1 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Misc OB - Res *CODE | None | |||||

| 2025 | 1980 | Mobile Home | 1,148 sqft | 0.00 | 8 | 0 | |

| 3.00 | Single Wide | Lap Siding | Central Air to Air | ||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2009 | Out Building | 1 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Misc OB - Res *CODE | None | |||||

| 2024 | 1980 | Mobile Home | 1,148 sqft | 0.00 | 8 | 0 | |

| 3.00 | Single Wide | Lap Siding | Central Air to Air | ||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2009 | Out Building | 1 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Misc OB - Res *CODE | None | |||||

| 2023 | 1980 | Mobile Home | 1,148 sqft | 0.00 | 8 | 0 | |

| 3.00 | Single Wide | Lap Siding | Central Air to Air | ||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $54,740 | $54,740 | - |

| Total Taxable Value (Capped) | $54,740 | $54,740 | - |

| Improvement Value | $8,640 | $8,640 | - |

| Land Value | $46,100 | $46,100 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $6,021 | $6,021 | - |

| Exemptions | -$2,000 | -$2,000 | -$2,000 |

| Net Assessed Value | $4,021 | $4,021 | - |

| School District | SP-8A | ||

| Tax Rate | 111.14 | 111.47 | 111.47 |

| Estimated taxes | $447 | $448 | - |

| Last Notice Date | There is no recent notice date for this property | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | |||

| Additional Homestead | |||

| Senior Valuation Limitation | |||

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 1/27/2020 | ORNDORFF, TEELA R & ANDREA LYNN REED | ORNDORFF, TEELA R | $0 | Quit Claim Deed | 2020007845 |

| 10/31/2017 | JONES, WILLIAM E AND DOROTHY M | ORNDORFF, TEELA R & ANDREA LYNN REED | $70,000 | General Warranty Deed | 2017103467 |

| 10/20/2017 | EVANS, ALICE ANN ET AL | JONES, WILLIAM E & DOROTHY M | $0 | Journal Entry Of Judgment | 2017098284 |

| 4/3/1989 | $0 | Special Warranty Deed | 2000289034 BK-05175PG-01880 |

Sales/Documents

| Sale Date | 1/27/2020 |

|---|---|

| Grantor | ORNDORFF, TEELA R & ANDREA LYNN REED |

| Grantee | ORNDORFF, TEELA R |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2020007845 |

| Sale Date | 10/31/2017 |

| Grantor | JONES, WILLIAM E AND DOROTHY M |

| Grantee | ORNDORFF, TEELA R & ANDREA LYNN REED |

| Sale Price | $70,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2017103467 |

| Sale Date | 10/20/2017 |

| Grantor | EVANS, ALICE ANN ET AL |

| Grantee | JONES, WILLIAM E & DOROTHY M |

| Sale Price | $0 |

| Deed Type | Journal Entry Of Judgment |

| Document Number | 2017098284 |

| Sale Date | 4/3/1989 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | Special Warranty Deed |

| Document Number | 2000289034 BK-05175PG-01880 |