General Information

| Situs Address | SPERRY 74073 |

|---|---|

| Owner Name |

CRASE, KENNETH D AND DELLA B

|

| Owner Mailing Address | 8588 N CINCINNATI AVE SPERRY , OK 74073 |

| Account Type | Comm Ag |

| Parcel ID | 91226-12-26-06610 |

| Land Area | 6.60 acres / 287,496 sq ft |

| School District | SP-8A |

| Legal Description | Subdivision: UNPLATTED (91226) Legal: BEG NEC NE TH S706.91 NW298.69 NW216.87 N154.44 NW66.89 NW89.15 SW181.92 SW190.45 NW173.14 NW54.65 NE94.32 E984.34 POB LESS .91AC FOR RD SEC 26 21 12 6.60AC Section: 26 Township: 21 Range: 12 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 1971 | Mobile Home | 980 sqft | 1.00 | 8 | 1.00 | |

| 1.00 | Single Wide | 18 Concrete | Metal Siding | Cool Air in Heat Ducts | |||

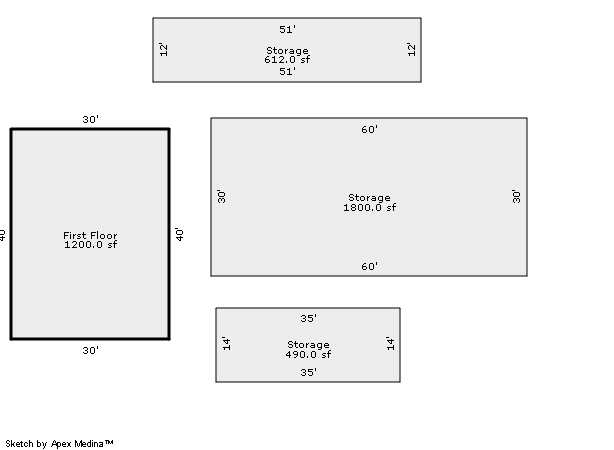

| 2025 | 1971 | Commercial | 1,200 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Roadside Markets | None | |||||

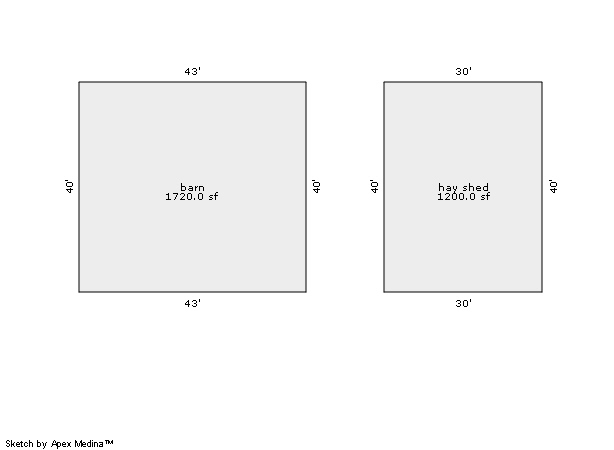

| 2025 | 1971 | Out Building | 1,720 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Barn | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1971 | Mobile Home | 980 sqft | 1.00 | 8 | 1.00 | |

| 1.00 | Single Wide | 18 Concrete | Metal Siding | Cool Air in Heat Ducts | |||

| 2024 | 1971 | Commercial | 1,200 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Roadside Markets | None | |||||

| 2024 | 1971 | Out Building | 1,720 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Barn | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1971 | Mobile Home | 980 sqft | 1.00 | 8 | 1.00 | |

| 1.00 | Single Wide | 18 Concrete | Metal Siding | Cool Air in Heat Ducts | |||

| 2023 | 1971 | Commercial | 1,200 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Roadside Markets | None | |||||

| 2023 | 1971 | Out Building | 1,720 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Barn | None | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $35,216 | $35,305 | - |

| Total Taxable Value (Capped) | $26,540 | $27,638 | - |

| Improvement Value | $29,004 | $29,093 | - |

| Land Value | $6,212 | $6,212 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $2,920 | $3,041 | - |

| Exemptions | -$1,000 | -$1,000 | -$1,000 |

| Net Assessed Value | $1,919 | $2,041 | - |

| School District | SP-8A | ||

| Tax Rate | 111.14 | 111.47 | 111.47 |

| Estimated taxes | $213 | $228 | - |

| Last Notice Date | 2/27/2024 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | |||

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 1/21/2016 | CRASE, KENNETH D & DELLA R | LINSINMEYER, SARAH ELIZABETH CRASE & ASHLEY VICTORIA CRASE HENDERSON | $0 | Transfer on Death | 2016006838 |

Sales/Documents

| Sale Date | 1/21/2016 |

|---|---|

| Grantor | CRASE, KENNETH D & DELLA R |

| Grantee | LINSINMEYER, SARAH ELIZABETH CRASE & ASHLEY VICTORIA CRASE HENDERSON |

| Sale Price | $0 |

| Deed Type | Transfer on Death |

| Document Number | 2016006838 |