General Information

| Situs Address | 4053 E 86 ST N SPERRY 74073 |

|---|---|

| Owner Name |

WYZARD, LLOYD AND CINDY

|

| Owner Mailing Address | PO BOX 575 SPERRY , OK 74073 |

| Account Type | Agricultural |

| Parcel ID | 91321-13-21-46810 |

| Land Area | 5.73 acres / 249,599 sq ft |

| School District | 11B |

| Legal Description | Subdivision: UNPLATTED (91321) Legal: BEG 162W SECR SW TH N484 W91 N30 W46 N299 E299 TO PT ON EL SW S483 E329.5 S330 W491.5 POB LESS BEG 162W SECR SW TH N44.84 NE128.28 ELY340 N115 ELY26.32 S185 W491.5 POB SEC 21 21 13 5.729ACS Section: 21 Township: 21 Range: 13 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

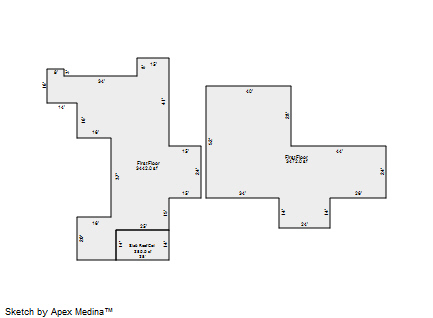

| 2025 | 1955 | Residential | 3,442 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | None | |||

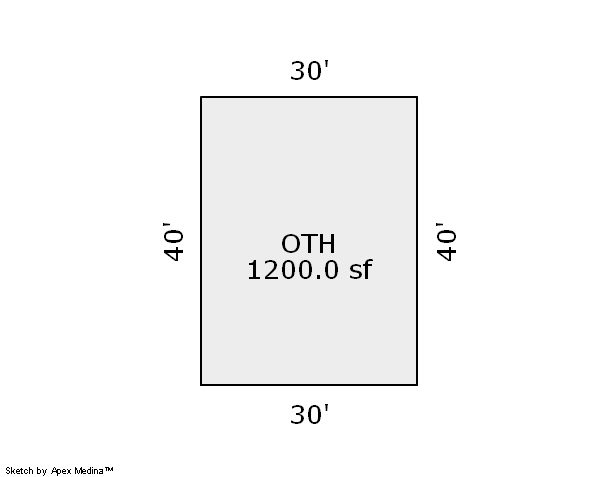

| 2025 | 1990 | Out Building | 1,200 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Barn | None | |||||

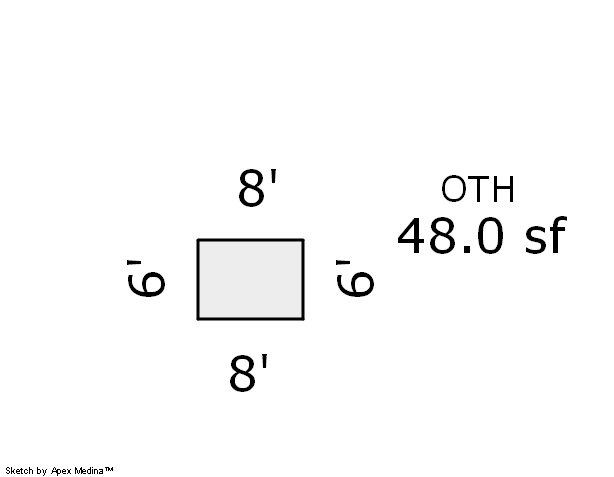

| 2025 | 1995 | Out Building | 48 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Shed - Equipment | None | |||||

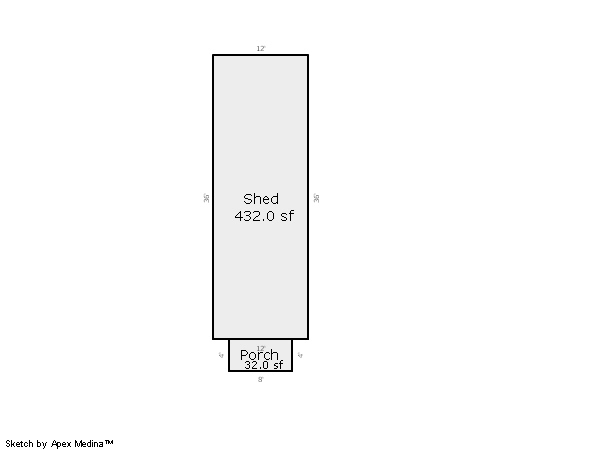

| 2025 | 1990 | Out Building | 432 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Storage - Material | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1955 | Residential | 3,442 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | None | |||

| 2024 | 1990 | Out Building | 1,200 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Barn | None | |||||

| 2024 | 1995 | Out Building | 48 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Shed - Equipment | None | |||||

| 2024 | 1990 | Out Building | 432 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Storage - Material | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1955 | Residential | 3,442 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | None | |||

| 2023 | 1990 | Out Building | 1,200 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Barn | None | |||||

| 2023 | 1995 | Out Building | 48 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Shed - Equipment | None | |||||

| 2023 | 1990 | Out Building | 432 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Storage - Material | None | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $197,969 | $197,970 | $197,369 |

| Total Taxable Value (Capped) | $165,402 | $170,364 | $175,475 |

| Improvement Value | $197,400 | $197,400 | $196,798 |

| Land Value | $569 | $570 | $571 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $18,194 | $18,740 | $19,303 |

| Exemptions | -$1,000 | -$1,000 | -$1,000 |

| Net Assessed Value | $17,194 | $17,740 | $18,303 |

| School District | 11B | ||

| Tax Rate | 108.83 | 110.79 | 110.79 |

| Estimated taxes | $1,871 | $1,965 | $2,028 |

| Last Notice Date | 3/25/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | |||

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| There is no sales information for this account | |||||

Sales/Documents

| There is no sales information for this account |