General Information

| Situs Address | 9411 N MEMORIAL DR E OWASSO 74055 |

|---|---|

| Owner Name |

FINNELL, HERBERT EARL & MELBA TRUST

|

| Owner Mailing Address | C/O TERRI WATSON 15573 HOLT RD SKIATOOK, OK 740704232 |

| Account Type | Agricultural |

| Parcel ID | 91324-13-24-23310 |

| Land Area | 74.63 acres / 3,250,883 sq ft |

| School District | 11B |

| Legal Description | Subdivision: UNPLATTED (91324) Legal: S/2 NW LESS W660 S330 THEREOF & LESS W16.5 THEREOF FOR RD SEC 24 21 13 74.625AC Section: 24 Township: 21 Range: 13 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

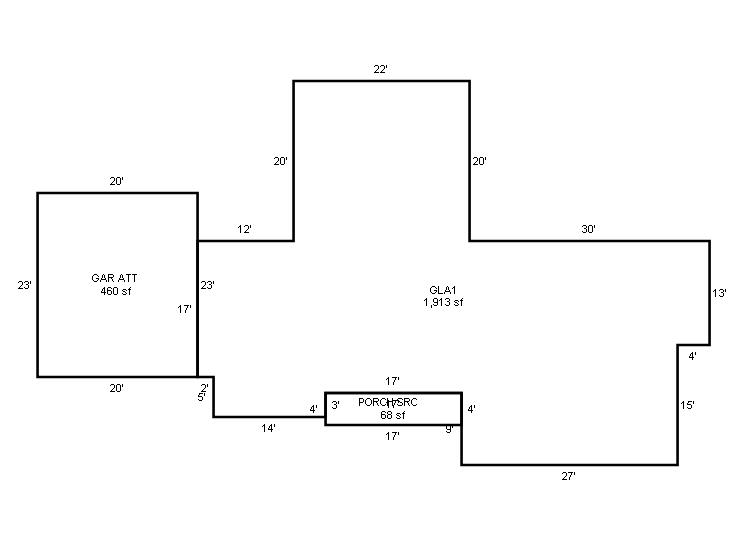

| 2025 | 1950 | Residential | 1,913 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Masonry Veneer | Cool Air in Heat Ducts | |||

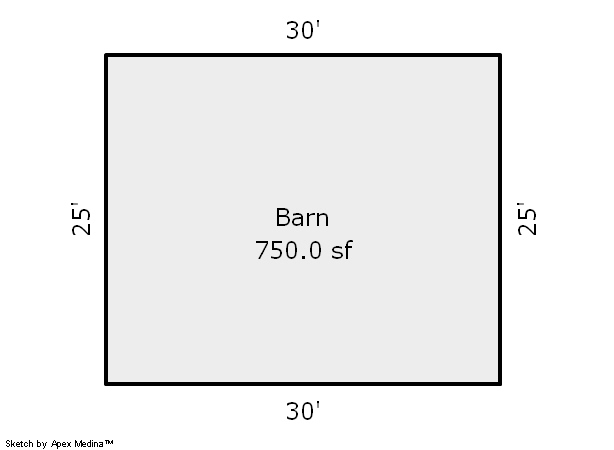

| 2025 | 1950 | Agricultural | 750 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Barn | None | |||||

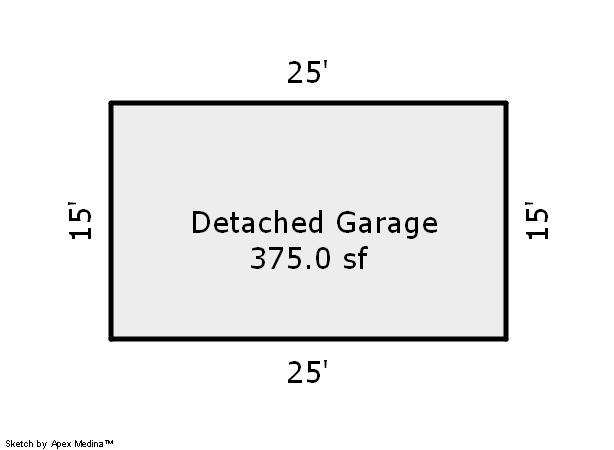

| 2025 | 1999 | Agricultural | 375 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Detached Garage | Frame Siding/Brick/Stone Veneer | None | ||||

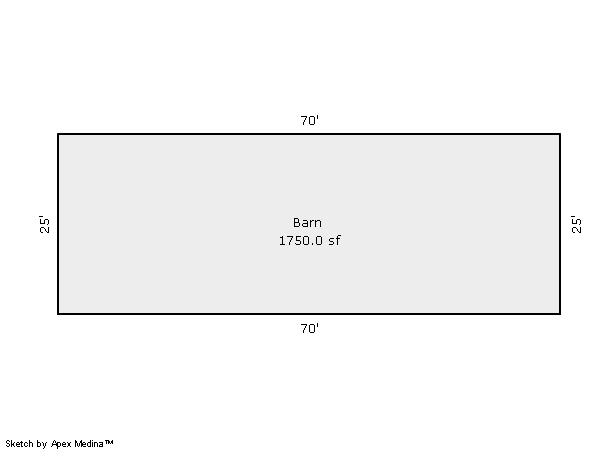

| 2025 | 1999 | Agricultural | 1,750 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Barn | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1950 | Residential | 1,913 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Masonry Veneer | Cool Air in Heat Ducts | |||

| 2024 | 1950 | Out Building | 750 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Barn | None | |||||

| 2024 | 1999 | Out Building | 375 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Detached Garage | Frame Siding/Brick/Stone Veneer | None | ||||

| 2024 | 1999 | Out Building | 1,750 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Barn | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1950 | Residential | 1,913 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Masonry Veneer | Cool Air in Heat Ducts | |||

| 2023 | 1950 | Out Building | 750 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Barn | None | |||||

| 2023 | 1999 | Out Building | 375 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Detached Garage | Frame Siding/Brick/Stone Veneer | None | ||||

| 2023 | 1999 | Out Building | 1,750 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Barn | None | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $134,241 | $133,368 | - |

| Total Taxable Value (Capped) | $112,522 | $112,522 | - |

| Improvement Value | $126,100 | $126,100 | - |

| Land Value | $8,141 | $7,268 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $12,377 | $12,378 | - |

| Exemptions | -$1,000 | -$1,000 | -$1,000 |

| Net Assessed Value | $11,377 | $11,377 | - |

| School District | 11B | ||

| Tax Rate | 108.83 | 110.79 | 110.79 |

| Estimated taxes | $1,238 | $1,260 | - |

| Last Notice Date | There is no recent notice date for this property | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | |||

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | |||

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 8/30/1996 | $0 | Quit Claim Deed | 2000290124 BK-05840PG-02411 |

Sales/Documents

| Sale Date | 8/30/1996 |

|---|---|

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2000290124 BK-05840PG-02411 |