General Information

| Situs Address | SKIATOOK 00000 |

|---|---|

| Owner Name |

LONE CREEK CATTLE COMPANY

|

| Owner Mailing Address | 4841 N 84TH ST LINCOLN , NE 685079700 |

| Account Type | Agricultural |

| Parcel ID | 92320-23-20-20910 |

| Land Area | 101.36 acres / 4,415,242 sq ft |

| School District | 7B |

| Legal Description | Subdivision: UNPLATTED (92320) Legal: E/2 E/2 NE & E/2 NE SE & NE SE SE & S/2 S/2 SE LESS BEG SECR SE TH W2649.74 TO SWC SE TH N142 E2649.43 S142 POB SEC 20 22 13 101.363ACS Section: 20 Township: 22 Range: 13 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

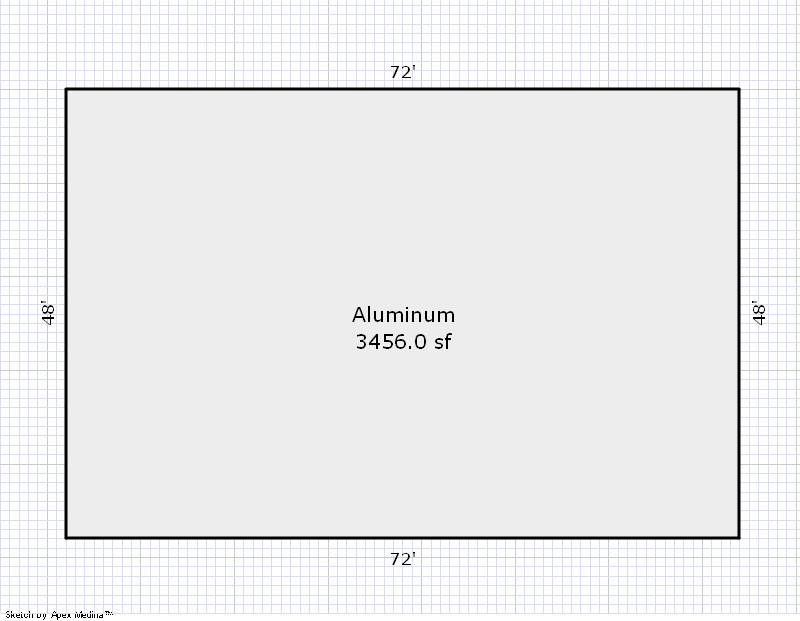

| 2025 | 1995 | Out Building | 3,456 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Barn | None | |||||

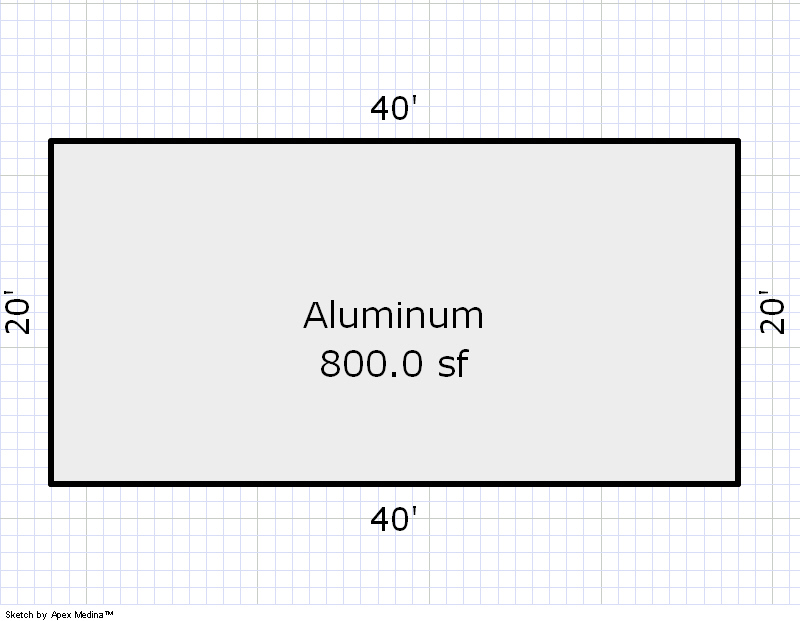

| 2025 | 2000 | Out Building | 800 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Farm Sun Shelters | None | |||||

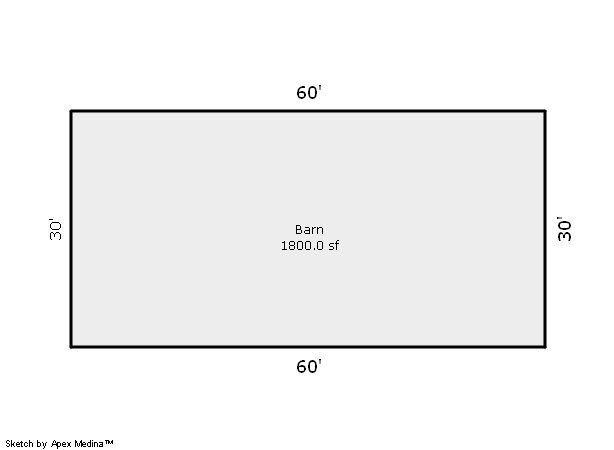

| 2025 | 2000 | Out Building | 1,800 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Shed - Utility | None | |||||

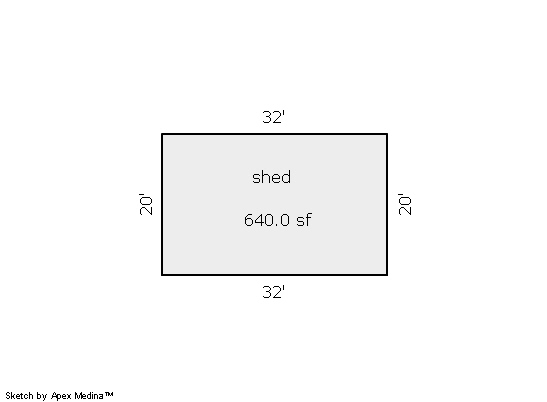

| 2025 | 2000 | Out Building | 640 sqft | 1.00 | 8 | 0.00 | |

| 5.00 | Shed - Utility | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1995 | Out Building | 3,456 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Barn | None | |||||

| 2024 | 2000 | Out Building | 800 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Farm Sun Shelters | None | |||||

| 2024 | 2000 | Out Building | 1,800 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Shed - Utility | None | |||||

| 2024 | 2000 | Out Building | 640 sqft | 1.00 | 8 | 0.00 | |

| 5.00 | Shed - Utility | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1995 | Out Building | 3,456 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Barn | None | |||||

| 2023 | 2000 | Out Building | 800 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Farm Sun Shelters | None | |||||

| 2023 | 2000 | Out Building | 1,800 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Shed - Utility | None | |||||

| 2023 | 2000 | Out Building | 640 sqft | 1.00 | 8 | 0.00 | |

| 5.00 | Shed - Utility | None | |||||

Additional Accounts

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $38,323 | $33,830 | $63,367 |

| Total Taxable Value (Capped) | $38,323 | $33,830 | $34,845 |

| Improvement Value | $25,500 | $24,000 | $53,498 |

| Land Value | $12,823 | $9,830 | $9,869 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $4,216 | $3,721 | $3,833 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $4,216 | $3,721 | $3,833 |

| School District | 7B | ||

| Tax Rate | 114.26 | 113.93 | 113.93 |

| Estimated taxes | $482 | $424 | $437 |

| Last Notice Date | 3/25/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 7/27/2018 | STAR LAKE LAND AND GAS COMPANY, LLC; STAR LAKE LAND & GAS COMPANY LLC | LONE CREEK CATTLE COMPANY | $12,479,500 | Special Warranty Deed | 2018069583 |

| 5/1/2006 | STAR LAKE CATTLE CO INC D | STAR LAKE LAND & GAS CO L | $9,290,000 | General Warranty Deed | 2006049308 |

Sales/Documents

| Sale Date | 7/27/2018 |

|---|---|

| Grantor | STAR LAKE LAND AND GAS COMPANY, LLC; STAR LAKE LAND & GAS COMPANY LLC |

| Grantee | LONE CREEK CATTLE COMPANY |

| Sale Price | $12,479,500 |

| Deed Type | Special Warranty Deed |

| Document Number | 2018069583 |

| Sale Date | 5/1/2006 |

| Grantor | STAR LAKE CATTLE CO INC D |

| Grantee | STAR LAKE LAND & GAS CO L |

| Sale Price | $9,290,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2006049308 |