General Information

| Situs Address | 14183 N LANTANA BV E SKIATOOK 74070 |

|---|---|

| Owner Name |

BAKER, JAMES LEE AND WANDA JEAN FAMILY TRUST

|

| Owner Mailing Address | PO BOX 5 COLLINSVILLE , OK 74021 |

| Account Type | Agricultural |

| Parcel ID | 92328-23-28-23765 |

| Land Area | 69.98 acres / 3,048,228 sq ft |

| School District | SK-6A |

| Legal Description | Subdivision: UNPLATTED (92328) Legal: PRT N/2 SEC BEG 314.68W SECR NE TH W2326.93 TO PT ON SWC NE W718.87 N632.97 E1417.86 N685.52 E1629.61 TO PT ON WL HWY R/W S1320.91 POB SEC 28 22 13 69.978ACS Section: 28 Township: 22 Range: 13 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 2021 | Residential | 2,636 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

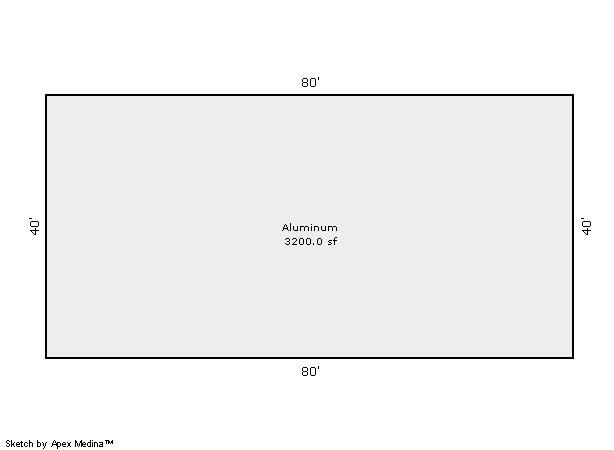

| 2025 | 2012 | Out Building | 3,200 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Farm Utility Storage - Loafing | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2021 | Residential | 2,636 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

| 2024 | 2012 | Out Building | 3,200 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Farm Utility Storage - Loafing | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2021 | Residential | 2,636 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

| 2023 | 2012 | Out Building | 3,200 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Farm Utility Storage - Loafing | None | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $249,546 | $248,185 | $245,183 |

| Total Taxable Value (Capped) | $249,546 | $248,185 | $245,183 |

| Improvement Value | $241,000 | $241,000 | $238,030 |

| Land Value | $8,546 | $7,185 | $7,153 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $27,450 | $27,300 | $26,970 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $27,450 | $27,300 | $26,970 |

| School District | SK-6A | ||

| Tax Rate | 113.87 | 115.33 | 115.33 |

| Estimated taxes | $3,126 | $3,149 | $3,110 |

| Last Notice Date | 3/29/2023 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 12/26/2012 | BAKER, JAMES LEE AND WANDA JEAN FAMILY TRUST | BAKER, JAMES LEE AND WANDA JEAN | $0 | Quit Claim Deed | 2013003154 |

Sales/Documents

| Sale Date | 12/26/2012 |

|---|---|

| Grantor | BAKER, JAMES LEE AND WANDA JEAN FAMILY TRUST |

| Grantee | BAKER, JAMES LEE AND WANDA JEAN |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2013003154 |