General Information

| Situs Address | 8815 E 126 ST N COLLINSVILLE 74021 |

|---|---|

| Owner Name |

CHAVIS, DELBERT LYNN

|

| Owner Mailing Address | 8815 E 126TH ST N COLLINSVILLE , OK 74021 |

| Account Type | Residential |

| Parcel ID | 92336-23-36-36550 |

| Land Area | 3.24 acres / 141,202 sq ft |

| School District | 6B |

| Legal Description | Subdivision: UNPLATTED (92336) Legal: TR BEG SECR SW TH W274.99 N530 E274.97 S530 POB LESS S16.5 THEREOF FOR RD SEC 36 22 13 3.242ACS Section: 36 Township: 22 Range: 13 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 2000 | Mobile Home | 1,512 sqft | 1.00 | 8 | 1.00 | |

| 1.00 | Single Wide | 18 Concrete | Metal Siding | Heat Pump | |||

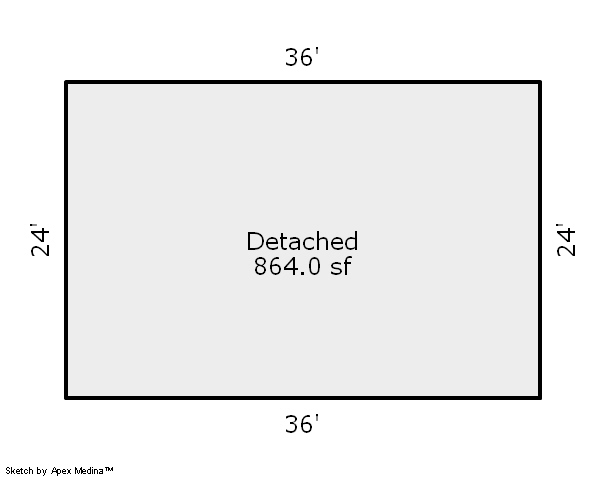

| 2025 | 2009 | Out Building | 864 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Detached Garage | Frame Corrugated Metal | None | ||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2000 | Mobile Home | 1,512 sqft | 1.00 | 8 | 1.00 | |

| 1.00 | Single Wide | 18 Concrete | Metal Siding | Heat Pump | |||

| 2024 | 2009 | Out Building | 864 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Detached Garage | Frame Corrugated Metal | None | ||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2000 | Mobile Home | 1,512 sqft | 1.00 | 8 | 1.00 | |

| 1.00 | Single Wide | 18 Concrete | Metal Siding | Heat Pump | |||

| 2023 | 2009 | Out Building | 864 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Detached Garage | Frame Corrugated Metal | None | ||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $107,200 | $107,200 | $107,200 |

| Total Taxable Value (Capped) | $107,200 | $107,200 | $107,200 |

| Improvement Value | $35,000 | $35,000 | $35,000 |

| Land Value | $72,200 | $72,200 | $72,200 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $11,792 | $11,792 | $11,792 |

| Exemptions | -$1,000 | -$1,000 | -$1,000 |

| Net Assessed Value | $10,792 | $10,792 | $10,792 |

| School District | 6B | ||

| Tax Rate | 113.87 | 115.33 | 115.33 |

| Estimated taxes | $1,229 | $1,245 | $1,245 |

| Last Notice Date | There is no recent notice date for this property | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | |||

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 6/1/2004 | $112,500 | Warranty Deed | 2000292737 BK-07309PG-00636 |

Sales/Documents

| Sale Date | 6/1/2004 |

|---|---|

| Grantor | |

| Grantee | |

| Sale Price | $112,500 |

| Deed Type | Warranty Deed |

| Document Number | 2000292737 BK-07309PG-00636 |