General Information

| Situs Address | 18701 S 75 HY W MOUNDS 74047 |

|---|---|

| Owner Name |

WELLS, JUDITH GAY AND GERALD LEE

|

| Owner Mailing Address | 18701 S HWY 75 MOUNDS , OK 74047 |

| Account Type | Agricultural |

| Parcel ID | 96202-62-02-43910 |

| Land Area | 40.00 acres / 1,742,400 sq ft |

| School District | GL-14A |

| Legal Description | Subdivision: UNPLATTED (96202) Legal: NW SW SEC 2 16 12 40ACS Section: 02 Township: 16 Range: 12 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

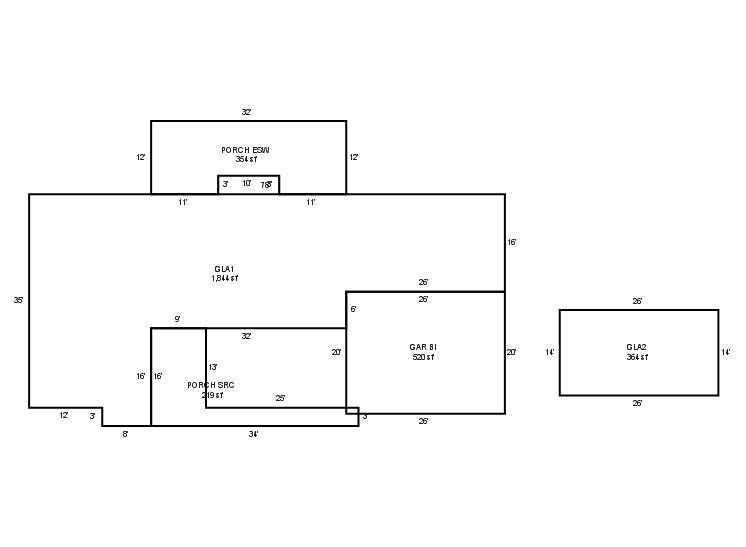

| 2025 | 1975 | Residential | 2,208 sqft | 1.50 | 8 | 1.10 | Clay Tile |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Stucco Veneer | Cool Air in Heat Ducts | |||

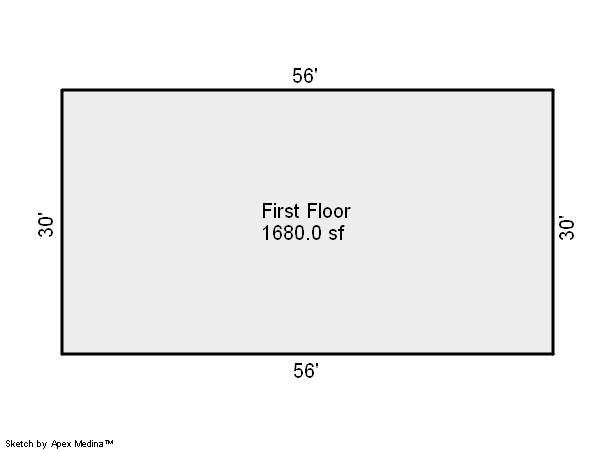

| 2025 | 1965 | Residential | 1,680 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | Ranch 1 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

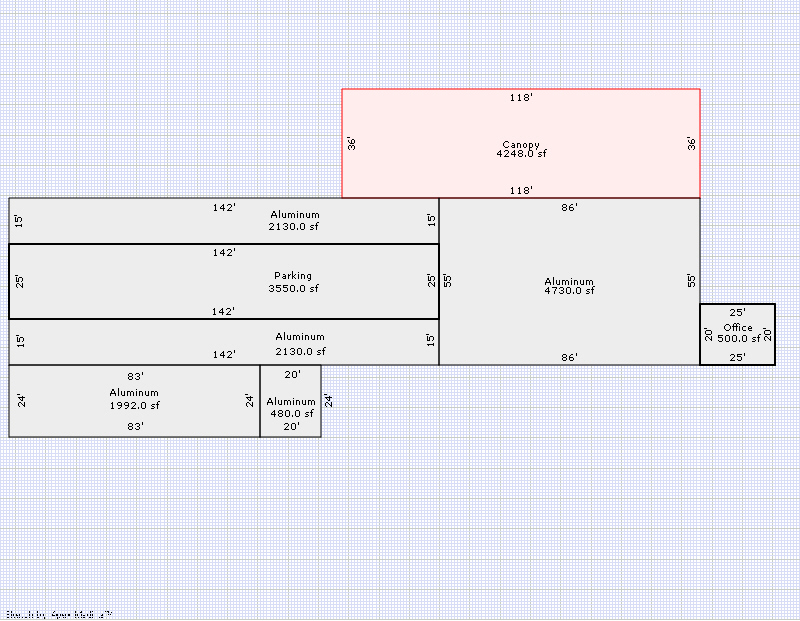

| 2025 | 1980 | Out Building | 4,730 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Equipment Building | None | |||||

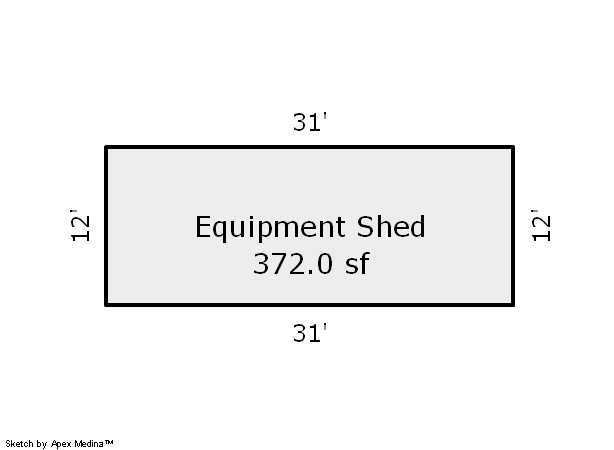

| 2025 | 1980 | Out Building | 372 sqft | 1.00 | 8 | 0.00 | |

| 5.00 | Shed - Equipment | None | |||||

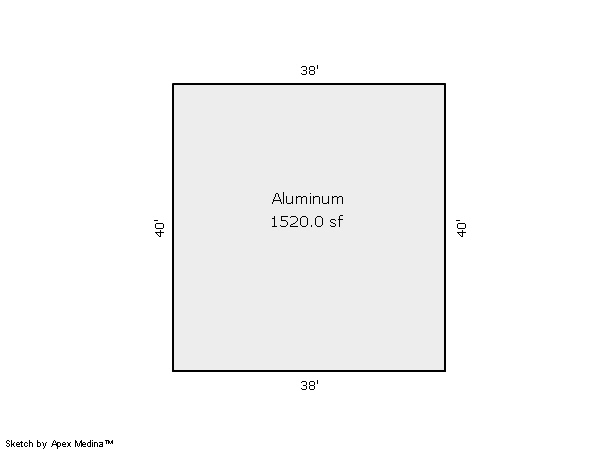

| 2025 | 1985 | Out Building | 1,520 sqft | 1.00 | 8 | 0.00 | |

| 6.00 | Equipment Building | None | |||||

| 2025 | 1985 | Out Building | 1,000 sqft | 1.00 | 8 | 0.00 | |

| 7.00 | Shed - Cattle | None | |||||

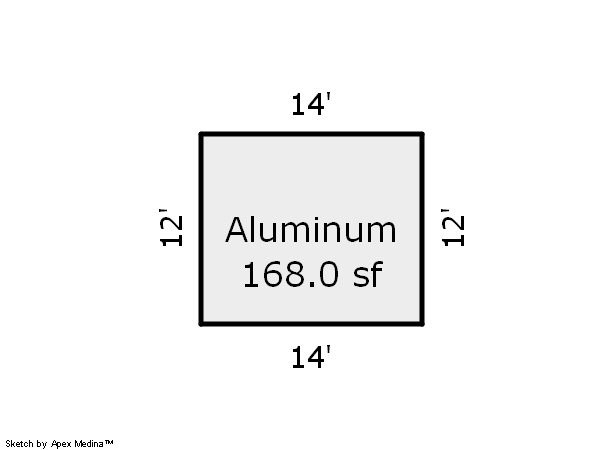

| 2025 | 1985 | Out Building | 168 sqft | 1.00 | 8 | 0.00 | |

| 8.00 | Shed - Cattle | None | |||||

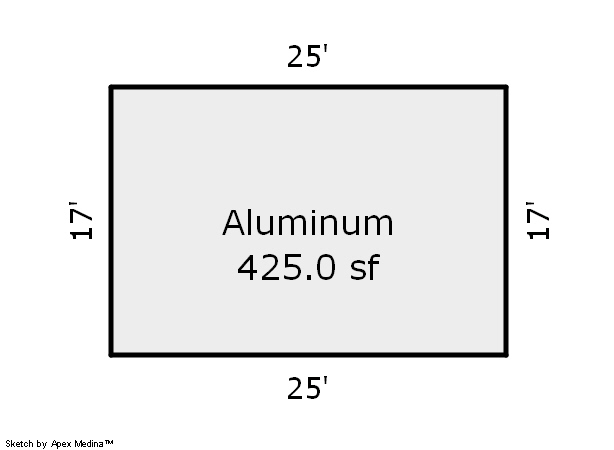

| 2025 | 1985 | Out Building | 425 sqft | 1.00 | 8 | 0.00 | |

| 10.00 | Farm Utility/Grain Storage Bldgs | None | |||||

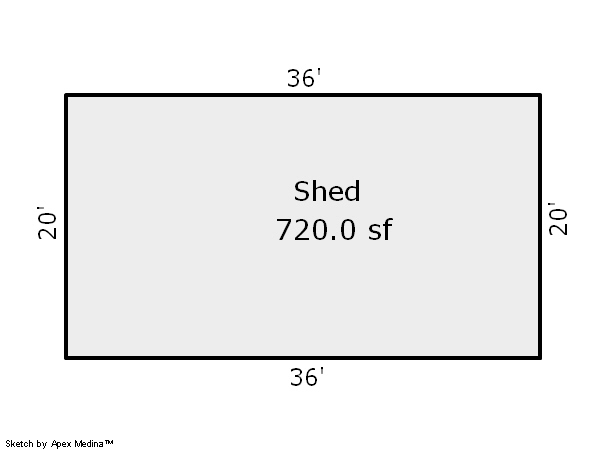

| 2025 | 1980 | Out Building | 720 sqft | 1.00 | 8 | 0.00 | |

| 11.00 | Shed - Cattle | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1975 | Residential | 2,208 sqft | 1.50 | 8 | 1.10 | Clay Tile |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Stucco Veneer | Cool Air in Heat Ducts | |||

| 2024 | 1965 | Residential | 1,680 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | Ranch 1 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

| 2024 | 1980 | Out Building | 4,730 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Equipment Building | None | |||||

| 2024 | 1980 | Out Building | 372 sqft | 1.00 | 8 | 0.00 | |

| 5.00 | Shed - Equipment | None | |||||

| 2024 | 1985 | Out Building | 1,520 sqft | 1.00 | 8 | 0.00 | |

| 6.00 | Equipment Building | None | |||||

| 2024 | 1985 | Out Building | 1,000 sqft | 1.00 | 8 | 0.00 | |

| 7.00 | Shed - Cattle | None | |||||

| 2024 | 1985 | Out Building | 168 sqft | 1.00 | 8 | 0.00 | |

| 8.00 | Shed - Cattle | None | |||||

| 2024 | 1985 | Out Building | 425 sqft | 1.00 | 8 | 0.00 | |

| 10.00 | Farm Utility/Grain Storage Bldgs | None | |||||

| 2024 | 1980 | Out Building | 720 sqft | 1.00 | 8 | 0.00 | |

| 11.00 | Shed - Cattle | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1975 | Residential | 2,208 sqft | 1.50 | 8 | 1.10 | Clay Tile |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Stucco Veneer | Cool Air in Heat Ducts | |||

| 2023 | 1965 | Residential | 1,680 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | Ranch 1 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

| 2023 | 1980 | Out Building | 4,730 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Equipment Building | None | |||||

| 2023 | 1980 | Out Building | 372 sqft | 1.00 | 8 | 0.00 | |

| 5.00 | Shed - Equipment | None | |||||

| 2023 | 1985 | Out Building | 1,520 sqft | 1.00 | 8 | 0.00 | |

| 6.00 | Equipment Building | None | |||||

| 2023 | 1985 | Out Building | 1,000 sqft | 1.00 | 8 | 0.00 | |

| 7.00 | Shed - Cattle | None | |||||

| 2023 | 1985 | Out Building | 168 sqft | 1.00 | 8 | 0.00 | |

| 8.00 | Shed - Cattle | None | |||||

| 2023 | 1985 | Out Building | 425 sqft | 1.00 | 8 | 0.00 | |

| 10.00 | Farm Utility/Grain Storage Bldgs | None | |||||

| 2023 | 1980 | Out Building | 720 sqft | 1.00 | 8 | 0.00 | |

| 11.00 | Shed - Cattle | None | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $235,581 | $235,581 | $271,566 |

| Total Taxable Value (Capped) | $183,621 | $189,130 | $194,804 |

| Improvement Value | $227,100 | $227,100 | $263,082 |

| Land Value | $8,481 | $8,481 | $8,484 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $20,198 | $20,804 | $21,428 |

| Exemptions | -$1,000 | -$1,000 | -$1,000 |

| Net Assessed Value | $19,198 | $19,804 | $20,428 |

| School District | GL-14A | ||

| Tax Rate | 109.05 | 106.86 | 106.86 |

| Estimated taxes | $2,094 | $2,116 | $2,183 |

| Last Notice Date | 3/25/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | |||

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 10/18/1993 | $0 | Quit Claim Deed | 2000293854 BK-05553PG-00390 |

Sales/Documents

| Sale Date | 10/18/1993 |

|---|---|

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2000293854 BK-05553PG-00390 |