General Information

| Situs Address | |

|---|---|

| Owner Name |

MEYER, TRAVIS G PROTECTION TRUST

|

| Owner Mailing Address | 1077 W 131ST ST S JENKS , OK 740372827 |

| Account Type | Agricultural |

| Parcel ID | 97202-72-02-59210 |

| Land Area | 45.96 acres / 2,002,018 sq ft |

| School District | GL-13A |

| Legal Description | Subdivision: UNPLATTED (97202) Legal: BEG SWC SE TH E150 N375 E170 N110 E150 S485 E1150 N1320 W1620 S1320 TO POB SEC 2 17 12 45.96ACS Section: 02 Township: 17 Range: 12 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 1980 | Out Building | 1,300 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Quonset | None | |||||

| 2025 | 1990 | Out Building | 200 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Shed - Cattle | None | |||||

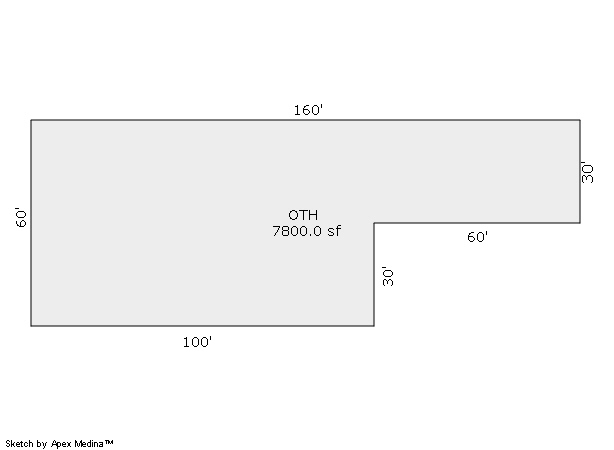

| 2025 | 2003 | Out Building | 900 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Barn | None | |||||

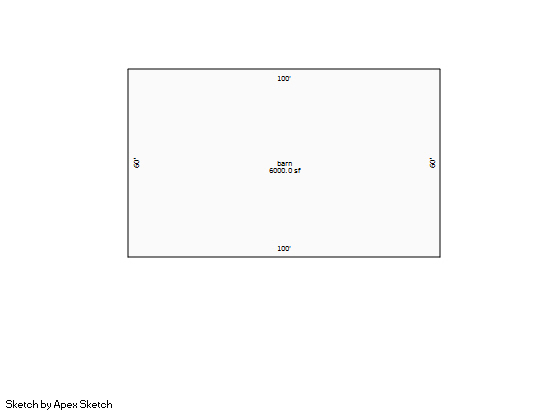

| 2025 | 2003 | Out Building | 6,000 sqft | 1.00 | 16 | 0.00 | |

| 5.00 | Barn | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

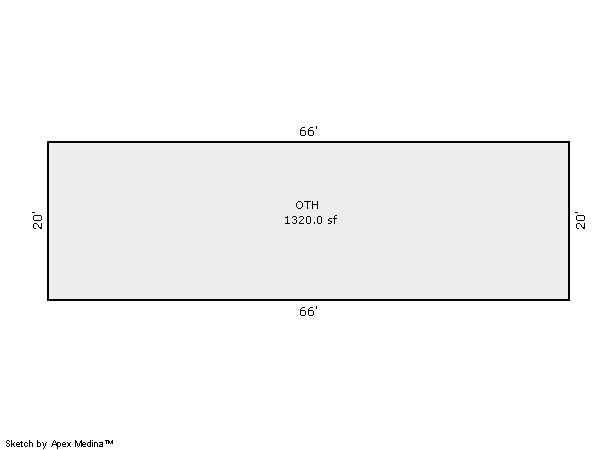

| 2024 | 1980 | Out Building | 1,300 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Quonset | None | |||||

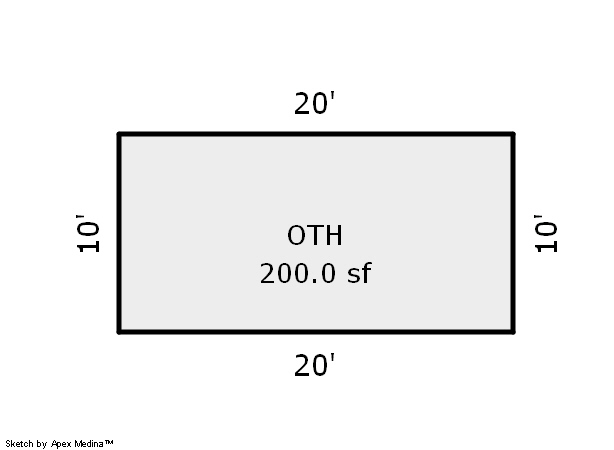

| 2024 | 1990 | Out Building | 200 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Shed - Cattle | None | |||||

| 2024 | 2003 | Out Building | 900 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Barn | None | |||||

| 2024 | 2003 | Out Building | 6,000 sqft | 1.00 | 16 | 0.00 | |

| 5.00 | Barn | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1980 | Out Building | 1,300 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Quonset | None | |||||

| 2023 | 1990 | Out Building | 200 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Shed - Cattle | None | |||||

| 2023 | 2003 | Out Building | 900 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Barn | None | |||||

| 2023 | 2003 | Out Building | 6,000 sqft | 1.00 | 16 | 0.00 | |

| 5.00 | Barn | None | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $91,444 | $91,444 | $166,148 |

| Total Taxable Value (Capped) | $63,311 | $65,210 | $67,166 |

| Improvement Value | $84,500 | $84,500 | $160,198 |

| Land Value | $6,944 | $6,944 | $5,950 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $6,964 | $7,173 | $7,389 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $6,964 | $7,173 | $7,389 |

| School District | GL-13A | ||

| Tax Rate | 117.07 | 120.02 | 120.02 |

| Estimated taxes | $815 | $861 | $887 |

| Last Notice Date | 3/25/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 12/7/2021 | MEYER, TRAVIS G | MEYER, TRAVIS G PROTECTION TRUST | $0 | Warranty Deed | 2021148631 |

| 12/31/2015 | MEYER, SUSAN | MEYER, TRAVIS G | $0 | Quit Claim Deed | 2016002013 |

| 9/3/1997 | $0 | Trustee's Deed | 2000294641 BK-05952PG-00632 |

Sales/Documents

| Sale Date | 12/7/2021 |

|---|---|

| Grantor | MEYER, TRAVIS G |

| Grantee | MEYER, TRAVIS G PROTECTION TRUST |

| Sale Price | $0 |

| Deed Type | Warranty Deed |

| Document Number | 2021148631 |

| Sale Date | 12/31/2015 |

| Grantor | MEYER, SUSAN |

| Grantee | MEYER, TRAVIS G |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2016002013 |

| Sale Date | 9/3/1997 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | Trustee's Deed |

| Document Number | 2000294641 BK-05952PG-00632 |