General Information

| Situs Address | E 151 ST S BIXBY 74008 |

|---|---|

| Owner Name |

OAKTRUST DEVELOPMENT LLC

|

| Owner Mailing Address | 1219 E 33RD ST TULSA , OK 741052017 |

| Account Type | Agricultural |

| Parcel ID | 97314-73-14-28810 |

| Land Area | 151.27 acres / 6,589,321 sq ft |

| School District | BI-4A |

| Legal Description | Subdivision: UNPLATTED (97314) Legal: E/2 SW & W/2 SE LESS BEG SWC W/2 SE TH N149.86 E643.18 SE230.36 SELY449.78 S97.03 W1321.61 POB & LESS BEG SECR E/2 SW TH W1321.62 N135.25 NE307.36 NELY558.28 E457.11 S149.86 POB SEC 14 17 13 151.265ACS Section: 14 Township: 17 Range: 13 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

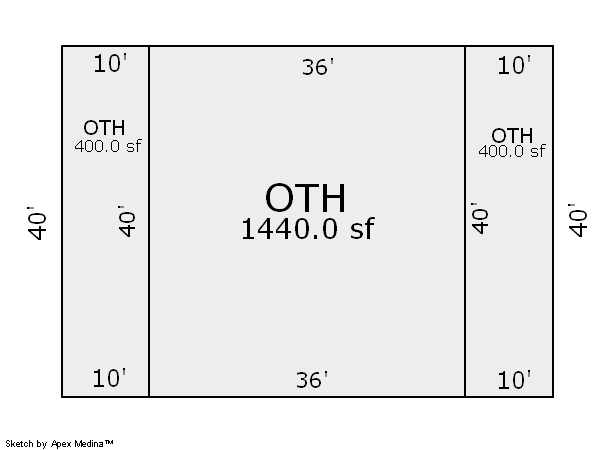

| 2025 | 1970 | Out Building | 2,240 sqft | 1.00 | 14 | 0.00 | |

| 2.00 | Barn | None | |||||

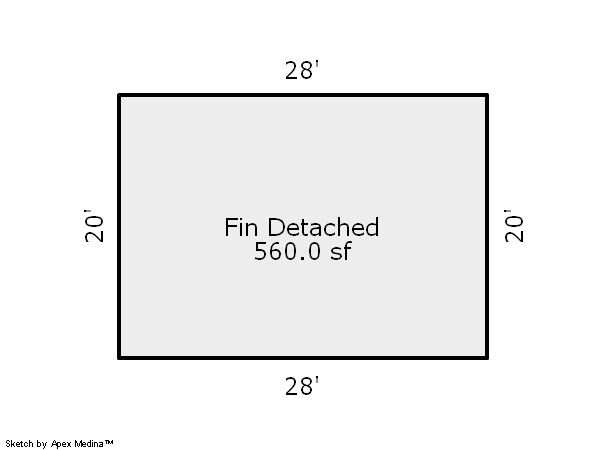

| 2025 | 1980 | Residential | 560 sqft | 1.00 | 8 | 0.00 | Composition Shingle |

| 3.00 | Detached Garage | Frame Siding/Brick/Stone Veneer | None | ||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1970 | Out Building | 2,240 sqft | 1.00 | 14 | 0.00 | |

| 2.00 | Barn | None | |||||

| 2024 | 1980 | Residential | 560 sqft | 1.00 | 8 | 0.00 | Composition Shingle |

| 3.00 | Detached Garage | Frame Siding/Brick/Stone Veneer | None | ||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1970 | Out Building | 2,240 sqft | 1.00 | 14 | 0.00 | |

| 2.00 | Barn | None | |||||

| 2023 | 1980 | Residential | 560 sqft | 1.00 | 8 | 0.00 | Composition Shingle |

| 3.00 | Detached Garage | Frame Siding/Brick/Stone Veneer | None | ||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $60,378 | $60,378 | $46,488 |

| Total Taxable Value (Capped) | $52,469 | $54,042 | $46,488 |

| Improvement Value | $8,000 | $8,000 | $12,526 |

| Land Value | $52,378 | $52,378 | $33,962 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $5,772 | $5,944 | $5,114 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $5,772 | $5,944 | $5,114 |

| School District | BI-4A | ||

| Tax Rate | 139.90 | 134.70 | 134.70 |

| Estimated taxes | $808 | $801 | $689 |

| Last Notice Date | 3/26/2024 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 2/20/2025 | CLAXTON, KENNETH P REV TRUST & BROACH, CHRISTOPHER CLAYTON | OAKTRUST DEVELOPMENT LLC | $6,200,000 | Special Warranty Deed | 2025014589 |

| 2/19/2025 | CLAXTON, KENNETH P TRUST & BROACH, CHRISTOPHER CLAYTON | OAKTRUST DEVELOPMENT LLC | $0 | Corrected Special Warranty Deed | 2025036724 |

| 12/29/2017 | BROACH, GEORGE CLAYTON TRUST | BROACH, CHRISTOPHER CLAYTON | $0 | Trustee's Deed | 2017119893 |

| 9/16/2002 | $0 | General Warranty Deed | 2000295509 BK-06824PG-01329 |

Sales/Documents

| Sale Date | 2/20/2025 |

|---|---|

| Grantor | CLAXTON, KENNETH P REV TRUST & BROACH, CHRISTOPHER CLAYTON |

| Grantee | OAKTRUST DEVELOPMENT LLC |

| Sale Price | $6,200,000 |

| Deed Type | Special Warranty Deed |

| Document Number | 2025014589 |

| Sale Date | 2/19/2025 |

| Grantor | CLAXTON, KENNETH P TRUST & BROACH, CHRISTOPHER CLAYTON |

| Grantee | OAKTRUST DEVELOPMENT LLC |

| Sale Price | $0 |

| Deed Type | Corrected Special Warranty Deed |

| Document Number | 2025036724 |

| Sale Date | 12/29/2017 |

| Grantor | BROACH, GEORGE CLAYTON TRUST |

| Grantee | BROACH, CHRISTOPHER CLAYTON |

| Sale Price | $0 |

| Deed Type | Trustee's Deed |

| Document Number | 2017119893 |

| Sale Date | 9/16/2002 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | General Warranty Deed |

| Document Number | 2000295509 BK-06824PG-01329 |