General Information

| Situs Address | |

|---|---|

| Owner Name |

MORTON, LINDA C & ANTHONY L

|

| Owner Mailing Address | 3636 W 61ST ST TULSA , OK 741321220 |

| Account Type | Residential |

| Parcel ID | 97332-73-32-78830 |

| Land Area | 5.65 acres / 246,141 sq ft |

| School District | 4B |

| Legal Description | Subdivision: UNPLATTED (97332) Legal: PRT NW SE NW BEG 40W & 1463.71S NEC W/2 E/2 NE TH S516.66 W476.33 N516.77 E476.39 POB SEC 32 17 13 5.651ACS Section: 32 Township: 17 Range: 13 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

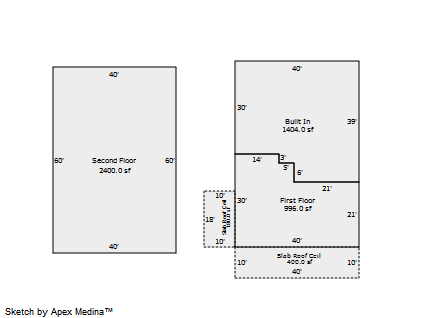

| 2025 | 2013 | Residential | 3,396 sqft | 2.00 | 8 | 3.00 | Preformed Metal |

| 1.00 | 2 Story | Slab | Frame Corrugated Metal | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2013 | Residential | 3,396 sqft | 2.00 | 8 | 3.00 | Preformed Metal |

| 1.00 | 2 Story | Slab | Frame Corrugated Metal | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2013 | Residential | 3,396 sqft | 2.00 | 8 | 3.00 | Preformed Metal |

| 1.00 | 2 Story | Slab | Frame Corrugated Metal | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $307,400 | $307,400 | - |

| Total Taxable Value (Capped) | $307,400 | $307,400 | - |

| Improvement Value | $148,400 | $148,400 | - |

| Land Value | $159,000 | $159,000 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $33,814 | $33,814 | - |

| Exemptions | $0 | $0 | - |

| Net Assessed Value | $33,814 | $33,814 | - |

| School District | 4B | ||

| Tax Rate | 118.07 | 113.66 | 113.66 |

| Estimated taxes | $3,992 | $3,843 | - |

| Last Notice Date | 1/31/2023 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 5/16/2024 | MORTON, LINDA C & HOWARD L III & ANTHONY L & TONYA JEAN | MORTON, LINDA C & ANTHONY L | $0 | Quit Claim Deed | 2024039659 |

| 8/26/2019 | INTEGRITY TRANSPORTATION LLC | MORTON, LINDA C & ANTHONY L | $0 | Warranty Deed | 2019080969 |

Sales/Documents

| Sale Date | 5/16/2024 |

|---|---|

| Grantor | MORTON, LINDA C & HOWARD L III & ANTHONY L & TONYA JEAN |

| Grantee | MORTON, LINDA C & ANTHONY L |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2024039659 |

| Sale Date | 8/26/2019 |

| Grantor | INTEGRITY TRANSPORTATION LLC |

| Grantee | MORTON, LINDA C & ANTHONY L |

| Sale Price | $0 |

| Deed Type | Warranty Deed |

| Document Number | 2019080969 |