General Information

| Situs Address | 16465 S 161 AV E BIXBY 74008 |

|---|---|

| Owner Name |

SHANKS, LINN LEON TRUSTEE LINN LEON &

|

| Owner Mailing Address | MARY MCLEARAN SHANKS TRUST 17420 E 161ST ST S BIXBY, OK 74008 |

| Account Type | Agricultural |

| Parcel ID | 97426-74-26-15610 |

| Land Area | 72.45 acres / 3,155,922 sq ft |

| School District | 4B |

| Legal Description | Subdivision: UNPLATTED (97426) Legal: S/2 NW LYING N HWY 64 SEC 26 17 14 72.454ACS Section: 26 Township: 17 Range: 14 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

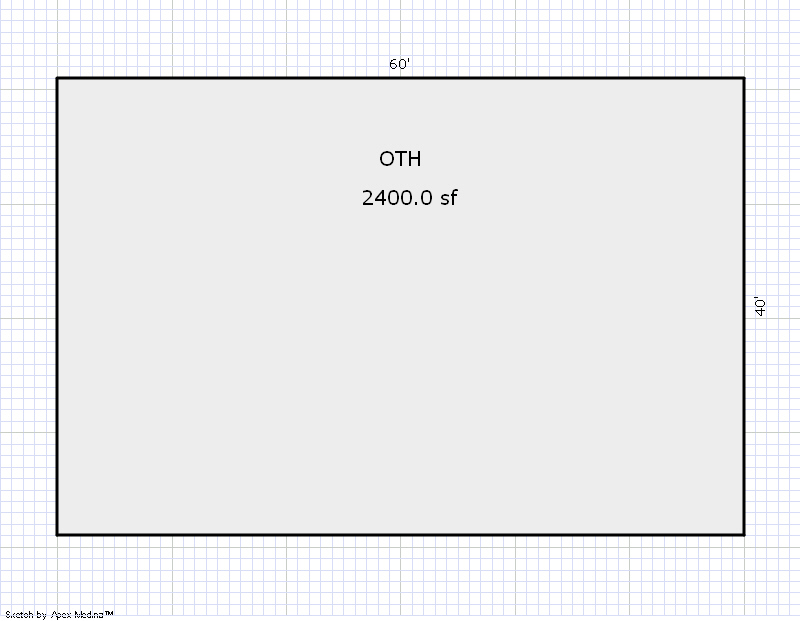

| 2025 | 1995 | Out Building | 2,400 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Barn | None | |||||

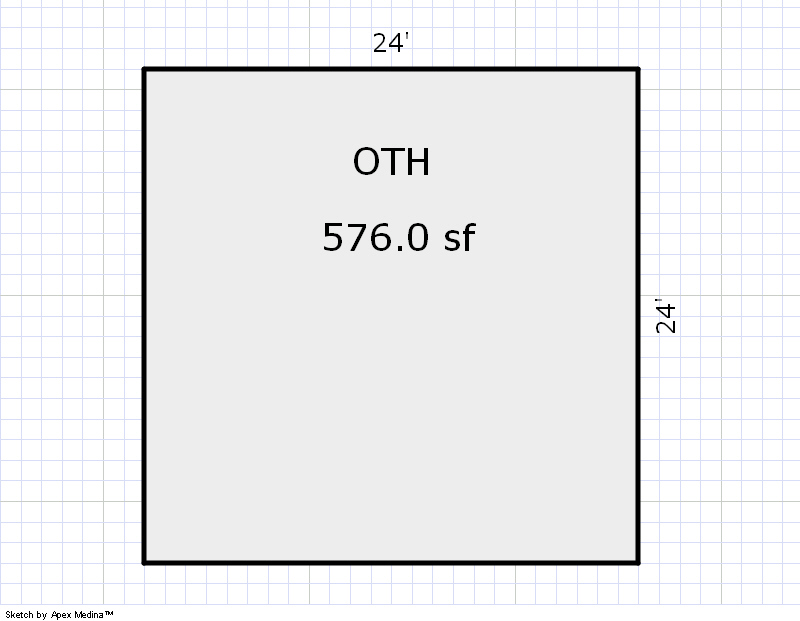

| 2025 | 1995 | Out Building | 576 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Shed - Utility | None | |||||

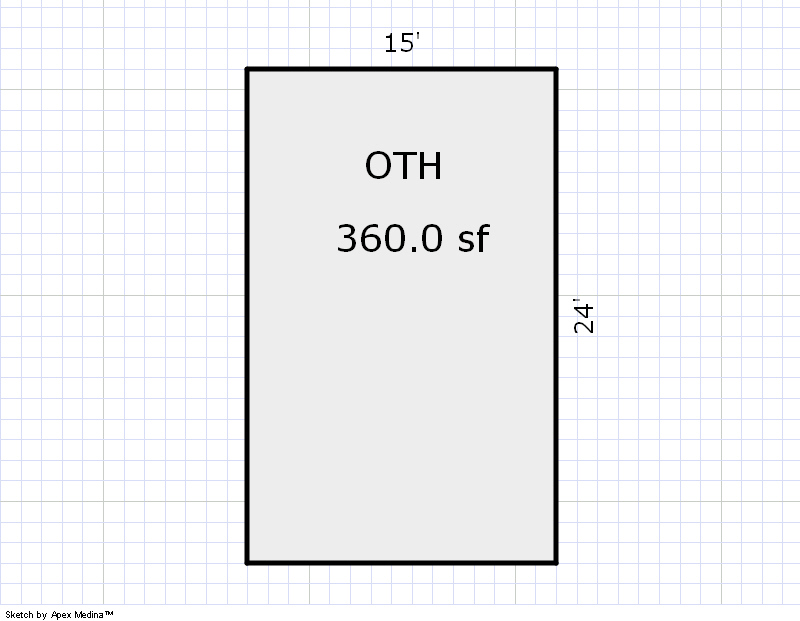

| 2025 | 1995 | Out Building | 360 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Shed - Cattle | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1995 | Out Building | 2,400 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Barn | None | |||||

| 2024 | 1995 | Out Building | 576 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Shed - Utility | None | |||||

| 2024 | 1995 | Out Building | 360 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Shed - Cattle | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1995 | Out Building | 2,400 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Barn | None | |||||

| 2023 | 1995 | Out Building | 576 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Shed - Utility | None | |||||

| 2023 | 1995 | Out Building | 360 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Shed - Cattle | None | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $17,167 | $17,167 | $23,228 |

| Total Taxable Value (Capped) | $13,058 | $13,449 | $13,853 |

| Improvement Value | $5,000 | $5,000 | $13,181 |

| Land Value | $12,167 | $12,167 | $10,047 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $1,436 | $1,480 | $1,524 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $1,436 | $1,480 | $1,524 |

| School District | 4B | ||

| Tax Rate | 118.07 | 113.66 | 113.66 |

| Estimated taxes | $170 | $168 | $173 |

| Last Notice Date | 3/25/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 1/6/2025 | SHANKS, LINN LEON TRUSTEE, LINN LEON & | GRAHAM, REBECCA & MICHAEL | $480,000 | General Warranty Deed | 2025002082 |

Sales/Documents

| Sale Date | 1/6/2025 |

|---|---|

| Grantor | SHANKS, LINN LEON TRUSTEE, LINN LEON & |

| Grantee | GRAHAM, REBECCA & MICHAEL |

| Sale Price | $480,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2025002082 |