Exempt

This property is Exempt Residential

R98306830611990

6121 S TRENTON AV E TULSA 74136

$138,389

$0

General Information

| Situs Address | 6121 S TRENTON AV E TULSA 74136 |

|---|---|

| Owner Name |

6111 S TRENTON AVE LLC

|

| Owner Mailing Address | PO BOX 641 BETHANY , OK 730080641 |

| Account Type | Exempt Res |

| Parcel ID | 98306-83-06-11990 |

| Land Area | 0.43 acres / 18,824 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: UNPLATTED (98306) Legal: PRT W/2 NE GOV LT 3 BEG 220.45S & 25E NWC W/2 NE GOV LT 3 TH E158 S119.14 W158 N119.30 POB SEC 6 18 13 .432AC Section: 06 Township: 18 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

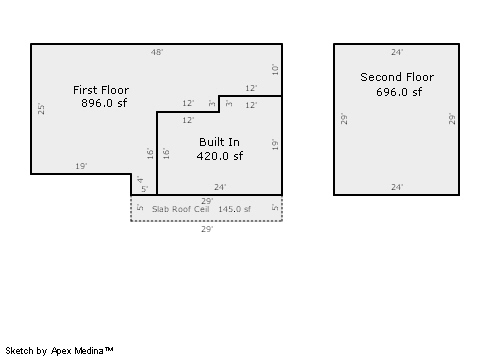

| 2025 | 1955 | Residential | 1,592 sqft | 2.00 | 8 | 1.10 | Composition Shingle |

| 1.00 | 2 Story | Crawl Space | Frame Masonry Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1955 | Residential | 1,592 sqft | 2.00 | 8 | 1.10 | Composition Shingle |

| 1.00 | 2 Story | Crawl Space | Frame Masonry Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1955 | Residential | 1,592 sqft | 2.00 | 8 | 1.10 | Composition Shingle |

| 1.00 | 2 Story | Crawl Space | Frame Masonry Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $206,710 | $138,389 | $138,389 |

| Total Taxable Value (Capped) | $145,343 | $138,389 | $138,389 |

| Improvement Value | $182,730 | $114,409 | $0 |

| Land Value | $23,980 | $23,980 | $0 |

| Assessment Ratio | 11% | 11% | 0% |

| Gross Assessed Value | $15,988 | $15,223 | $0 |

| Exemptions | -$1,000 | $0 | $0 |

| Net Assessed Value | $14,988 | $15,223 | $0 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $1,902 | $1,972 | $0 |

| Last Notice Date | 1/30/2024 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 4/4/2025 | HOPE CENTER MINISTRIES INC | 6111 S TRENTON AVE LLC | $0 | Warranty Deed | 2025039193 |

| 4/13/2023 | JOHNSTON, JULIE | HOPE CENTER MINISTRIES INC | $232,000 | Warranty Deed | 2023029506 |

| 4/30/2020 | JOHNSTON, JULIE ANN | JOHNSTON, RYAN DANIEL & KELLY MARIE STORY & AMY LEANNE HAMILTON | $0 | Transfer on Death | 2020042323 |

| 6/16/2008 | WILLIAMSON, JAMES A AND SANDRA J | JOHNSTON, JULIE | $137,000 | General Warranty Deed | 2008062717 |

| 10/1/2007 | $98,000 | Warranty Deed | 2007118597 |

Sales/Documents

| Sale Date | 4/4/2025 |

|---|---|

| Grantor | HOPE CENTER MINISTRIES INC |

| Grantee | 6111 S TRENTON AVE LLC |

| Sale Price | $0 |

| Deed Type | Warranty Deed |

| Document Number | 2025039193 |

| Sale Date | 4/13/2023 |

| Grantor | JOHNSTON, JULIE |

| Grantee | HOPE CENTER MINISTRIES INC |

| Sale Price | $232,000 |

| Deed Type | Warranty Deed |

| Document Number | 2023029506 |

| Sale Date | 4/30/2020 |

| Grantor | JOHNSTON, JULIE ANN |

| Grantee | JOHNSTON, RYAN DANIEL & KELLY MARIE STORY & AMY LEANNE HAMILTON |

| Sale Price | $0 |

| Deed Type | Transfer on Death |

| Document Number | 2020042323 |

| Sale Date | 6/16/2008 |

| Grantor | WILLIAMSON, JAMES A AND SANDRA J |

| Grantee | JOHNSTON, JULIE |

| Sale Price | $137,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2008062717 |

| Sale Date | 10/1/2007 |

| Grantor | |

| Grantee | |

| Sale Price | $98,000 |

| Deed Type | Warranty Deed |

| Document Number | 2007118597 |