General Information

| Situs Address | |

|---|---|

| Owner Name |

PARKER FARM LLC

|

| Owner Mailing Address | C/O STEVE EATON 301 E MAIN ST JENKS, OK 740374132 |

| Account Type | Agricultural |

| Parcel ID | 98330-83-30-32740 |

| Land Area | 70.69 acres / 3,079,256 sq ft |

| School District | JK-5A |

| Legal Description | Subdivision: UNPLATTED (98330) Legal: LT 4 & SE SW LESS TR BEG 702.48N SECR LT 4 TH W79.51 N557.93 SE793.27 SW277.27 NW356.78 TO POB & LESS BEG NWC SW SW THE207.31 S86.36 SW94.99 SLY428.01 S673.61 E6.07 S19 E132.51 S55.7 W TO SWC SW TH N TO POB SEC 30 18 13 70.691ACS Section: 30 Township: 18 Range: 13 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

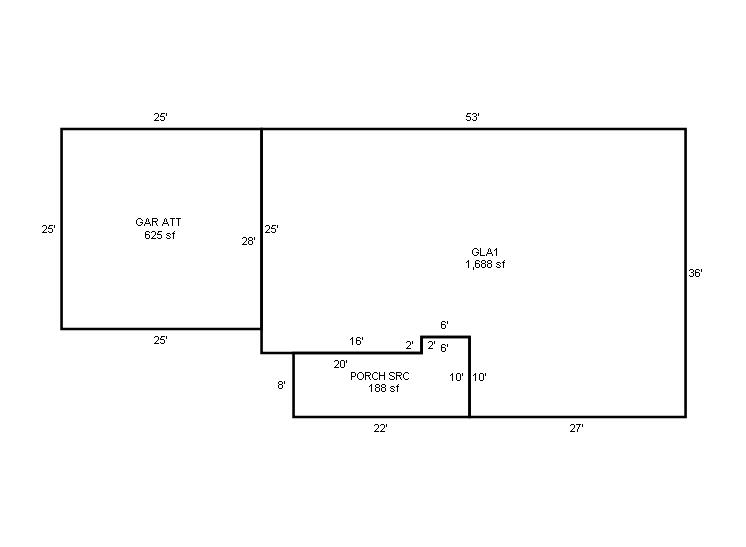

| 2025 | 1961 | Residential | 1,688 sqft | 1.00 | 8 | 1.10 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

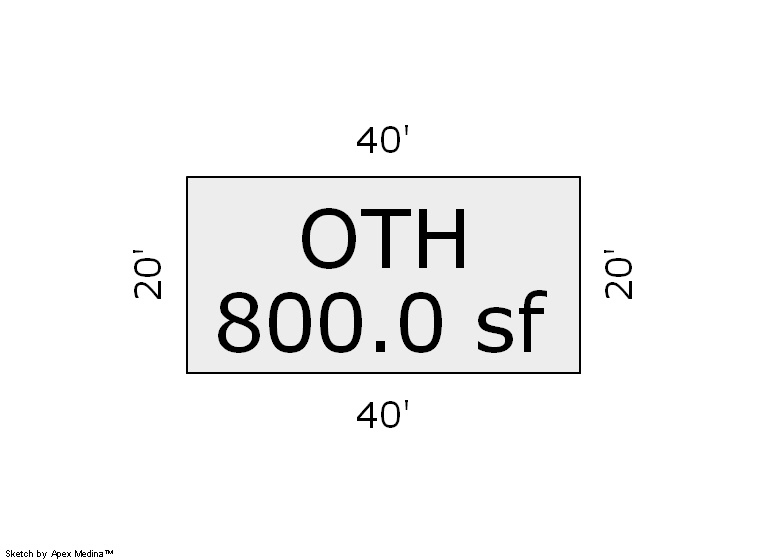

| 2025 | 1980 | Out Building | 800 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Shed - Cattle | None | |||||

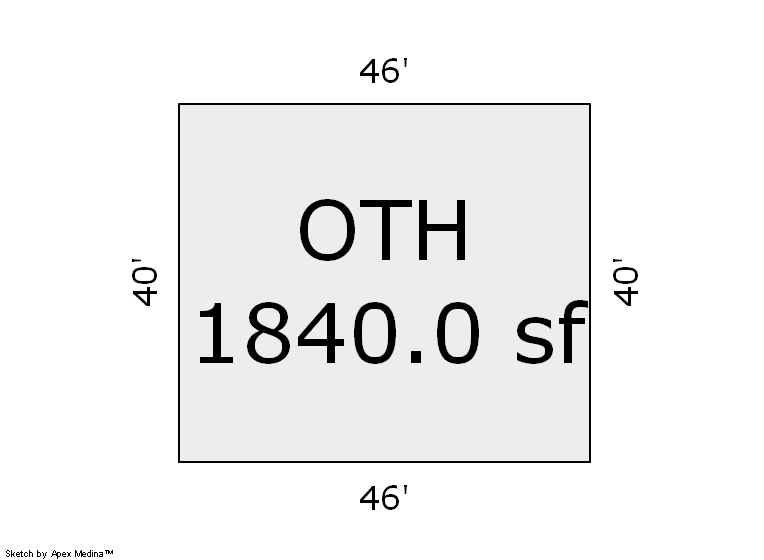

| 2025 | 1980 | Out Building | 1,840 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Barn | None | |||||

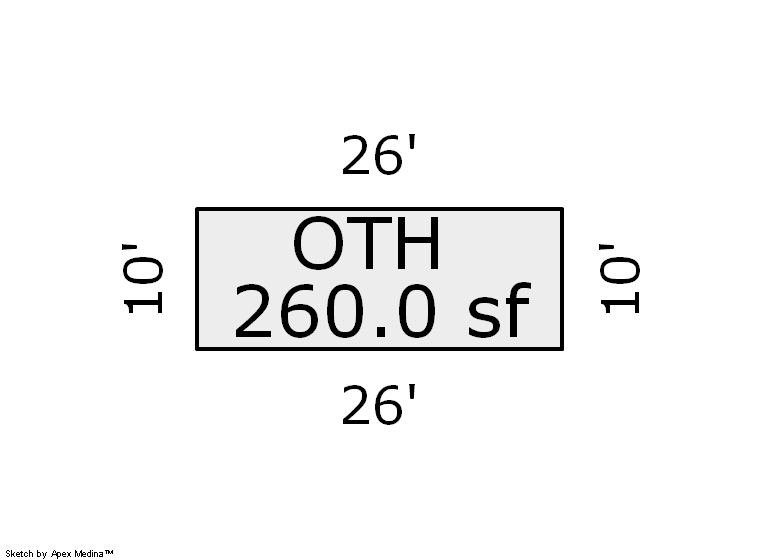

| 2025 | 1990 | Out Building | 260 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Shed - Utility | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1961 | Residential | 1,688 sqft | 1.00 | 8 | 1.10 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

| 2024 | 1980 | Out Building | 800 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Shed - Cattle | None | |||||

| 2024 | 1980 | Out Building | 1,840 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Barn | None | |||||

| 2024 | 1990 | Out Building | 260 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Shed - Utility | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1961 | Residential | 1,688 sqft | 1.00 | 8 | 1.10 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

| 2023 | 1980 | Out Building | 800 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Shed - Cattle | None | |||||

| 2023 | 1980 | Out Building | 1,840 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Barn | None | |||||

| 2023 | 1990 | Out Building | 260 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Shed - Utility | None | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $109,157 | $109,157 | - |

| Total Taxable Value (Capped) | $73,994 | $76,213 | - |

| Improvement Value | $101,000 | $101,000 | - |

| Land Value | $8,157 | $8,157 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $8,140 | $8,383 | - |

| Exemptions | $0 | $0 | - |

| Net Assessed Value | $8,140 | $8,383 | - |

| School District | JK-5A | ||

| Tax Rate | 127.32 | 126.54 | 126.54 |

| Estimated taxes | $1,036 | $1,061 | - |

| Last Notice Date | 3/26/2024 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 3/16/2009 | POLECAT BOTTOMS LLC | PARKER FARM LLC | $0 | Quit Claim Deed | 2009024438 |

| 3/7/2000 | $0 | Corrected General Warranty Deed | 2000299539 BK-06335PG-01149 |

Sales/Documents

| Sale Date | 3/16/2009 |

|---|---|

| Grantor | POLECAT BOTTOMS LLC |

| Grantee | PARKER FARM LLC |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2009024438 |

| Sale Date | 3/7/2000 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | Corrected General Warranty Deed |

| Document Number | 2000299539 BK-06335PG-01149 |