General Information

| Situs Address | 307 E 111 ST S JENKS 74037 |

|---|---|

| Owner Name |

EATON, STEPHEN D & LIND C CO-TRUSTEES LINDA C EATON REV TRUST

|

| Owner Mailing Address | 301 E MAIN ST JENKS , OK 74037 |

| Account Type | Agricultural |

| Parcel ID | 98330-83-30-40130 |

| Land Area | 5.05 acres / 219,978 sq ft |

| School District | JK-5A |

| Legal Description | Subdivision: UNPLATTED (98330) Legal: PRT S/2 SW BEG 702.48N SECR GOV LT 4 TH W79.51 N557.93 SE793.27 SW277.27 W356.78 TO POB SEC 30 18 13 5.048ACS Section: 30 Township: 18 Range: 13 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

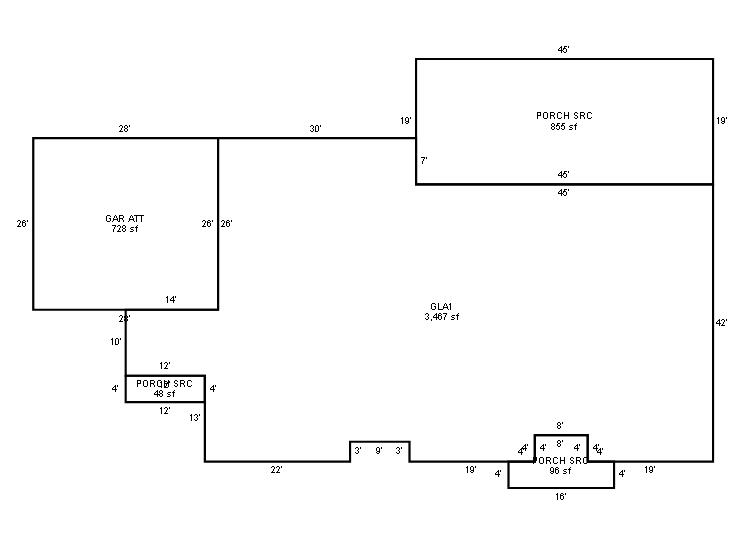

| 2025 | 2000 | Residential | 3,467 sqft | 1.00 | 8 | 3.00 | Preformed Metal |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

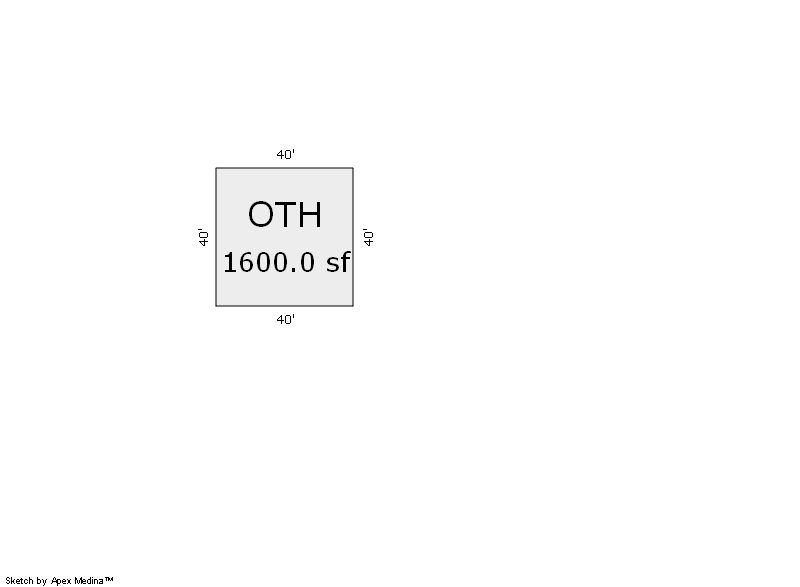

| 2025 | 2005 | Out Building | 1,600 sqft | 1.00 | 14 | 0.00 | |

| 2.00 | Equipment Storage | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2000 | Residential | 3,467 sqft | 1.00 | 8 | 3.00 | Preformed Metal |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

| 2024 | 2005 | Out Building | 1,600 sqft | 1.00 | 14 | 0.00 | |

| 2.00 | Equipment Storage | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2000 | Residential | 3,467 sqft | 1.00 | 8 | 3.00 | Preformed Metal |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

| 2023 | 2005 | Out Building | 1,600 sqft | 1.00 | 14 | 0.00 | |

| 2.00 | Equipment Storage | None | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $260,401 | $260,401 | $272,118 |

| Total Taxable Value (Capped) | $218,132 | $224,676 | $231,416 |

| Improvement Value | $260,000 | $260,000 | $271,717 |

| Land Value | $401 | $401 | $401 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $23,994 | $24,715 | $25,456 |

| Exemptions | -$1,000 | -$1,000 | -$1,000 |

| Net Assessed Value | $22,993 | $23,714 | $24,457 |

| School District | JK-5A | ||

| Tax Rate | 127.32 | 126.54 | 126.54 |

| Estimated taxes | $2,927 | $3,001 | $3,095 |

| Last Notice Date | 3/25/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | |||

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 5/27/2010 | EATON, STEPHEN D AND LINDA C | EATON, STEPHEN D & LIND C CO-TRUSTEES LINDA C EATON REV TRUST | $0 | Quit Claim Deed | 2010046438 |

| 3/16/2009 | POLECAT BOTTOMS LLC | EATON, STEPHEN D & LINDA C | $0 | Quit Claim Deed | 2009024437 |

| 5/24/1999 | $0 | General Warranty Deed | 2000299541 BK-06219PG-01290 |

Sales/Documents

| Sale Date | 5/27/2010 |

|---|---|

| Grantor | EATON, STEPHEN D AND LINDA C |

| Grantee | EATON, STEPHEN D & LIND C CO-TRUSTEES LINDA C EATON REV TRUST |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2010046438 |

| Sale Date | 3/16/2009 |

| Grantor | POLECAT BOTTOMS LLC |

| Grantee | EATON, STEPHEN D & LINDA C |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2009024437 |

| Sale Date | 5/24/1999 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | General Warranty Deed |

| Document Number | 2000299541 BK-06219PG-01290 |