General Information

| Situs Address | 9527 S GARNETT RD E BROKEN ARROW 74012 |

|---|---|

| Owner Name |

MORENO TRANSPORTATION LLC

|

| Owner Mailing Address | 3721 W FREEPORT ST BROKEN ARROW , OK 740122148 |

| Account Type | Residential |

| Parcel ID | 98420-84-20-36720 |

| Land Area | 8.97 acres / 390,764 sq ft |

| School District | BA-9A |

| Legal Description | Subdivision: UNPLATTED (98420) Legal: PRT SW NW BEG 79.20N SWC SW NW TH N415.8 E880 S495 W788.74 NW120.85 TO POB LESS BEG 79.20N SWC SW NW TH N415.80 E60 S333.61 SE245.41 W153.72 NWLY CRV LF 120.85 POB SEC 20 18 14 8.97ACS Section: 20 Township: 18 Range: 14 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

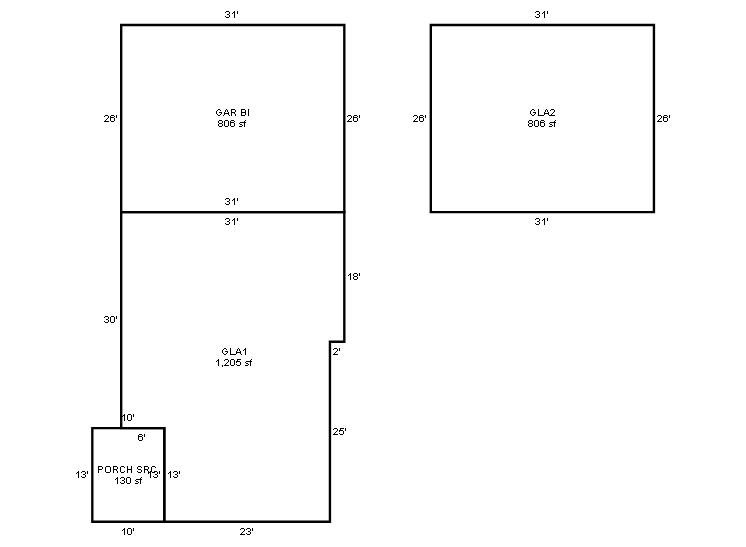

| 2025 | 1965 | Residential | 2,011 sqft | 2.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | 2 Story | Crawl Space | Frame Masonry Veneer | Cool Air in Heat Ducts | |||

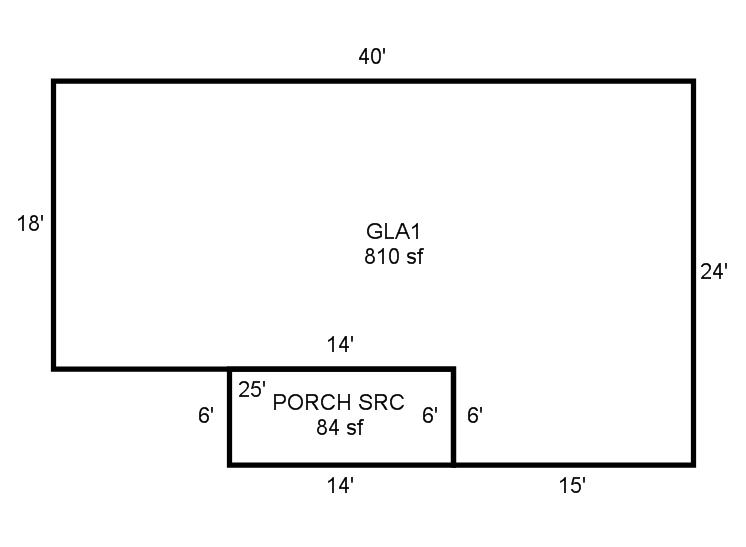

| 2025 | 1958 | Residential | 810 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | Ranch 1 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1965 | Residential | 2,011 sqft | 2.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | 2 Story | Crawl Space | Frame Masonry Veneer | Cool Air in Heat Ducts | |||

| 2024 | 1958 | Residential | 810 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | Ranch 1 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1965 | Residential | 2,011 sqft | 2.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | 2 Story | Crawl Space | Frame Masonry Veneer | Cool Air in Heat Ducts | |||

| 2023 | 1958 | Residential | 810 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | Ranch 1 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $175,995 | $175,995 | - |

| Total Taxable Value (Capped) | $97,694 | $102,579 | - |

| Improvement Value | $61,110 | $61,110 | - |

| Land Value | $114,885 | $114,885 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $10,746 | $11,284 | - |

| Exemptions | $0 | $0 | - |

| Net Assessed Value | $10,746 | $11,284 | - |

| School District | BA-9A | ||

| Tax Rate | 129.06 | 129.86 | 129.86 |

| Estimated taxes | $1,387 | $1,465 | - |

| Last Notice Date | 1/30/2024 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 6/27/2024 | BUNCH, ORPHA A | MORENO TRANSPORTATION LLC | $232,000 | Warranty Deed | 2024078462 |

| 6/27/2024 | BUNCH, LOY D & ORPHA A | BUNCH, ORPHA A | $0 | Affidavit Of Surviving Joint Tenant | 2024078461 |

Sales/Documents

| Sale Date | 6/27/2024 |

|---|---|

| Grantor | BUNCH, ORPHA A |

| Grantee | MORENO TRANSPORTATION LLC |

| Sale Price | $232,000 |

| Deed Type | Warranty Deed |

| Document Number | 2024078462 |

| Sale Date | 6/27/2024 |

| Grantor | BUNCH, LOY D & ORPHA A |

| Grantee | BUNCH, ORPHA A |

| Sale Price | $0 |

| Deed Type | Affidavit Of Surviving Joint Tenant |

| Document Number | 2024078461 |