General Information

| Situs Address | 10328 S 177 AV E BROKEN ARROW 74011 |

|---|---|

| Owner Name |

PW LAND HOLDING LLC

|

| Owner Mailing Address | 5555 E 71ST ST STE 7300 TULSA , OK 741366552 |

| Account Type | Agricultural |

| Parcel ID | 98426-84-26-04210 |

| Land Area | 25.44 acres / 1,108,266 sq ft |

| School District | BA-3A |

| Legal Description | Subdivision: UNPLATTED (98426) Legal: SE NE LESS S194.4 E560 & LESS N796 S990.4 E660 THEREOF SEC 26 18 14 25.40ACS Section: 26 Township: 18 Range: 14 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

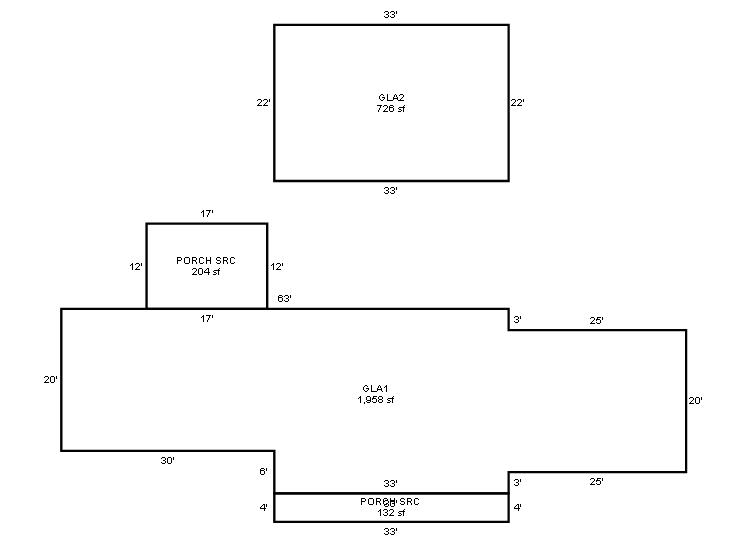

| 2025 | 1965 | Residential | 2,684 sqft | 2.00 | 8 | 3.00 | Composition Shingle |

| 1.00 | 1½ Story Fin | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

| 2025 | 2011 | Out Building | 0 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Shed - Cattle | None | |||||

| 2025 | 1965 | Out Building | 0 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Barn | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1965 | Residential | 2,684 sqft | 2.00 | 8 | 3.00 | Composition Shingle |

| 1.00 | 1½ Story Fin | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

| 2024 | 2011 | Out Building | 0 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Shed - Cattle | None | |||||

| 2024 | 1965 | Out Building | 0 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Barn | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1965 | Residential | 2,684 sqft | 2.00 | 8 | 3.00 | Composition Shingle |

| 1.00 | 1½ Story Fin | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

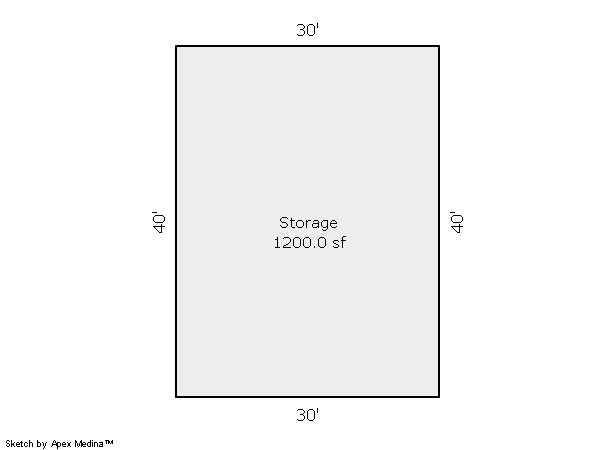

| 2023 | 2011 | Out Building | 1,200 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Shed - Cattle | None | |||||

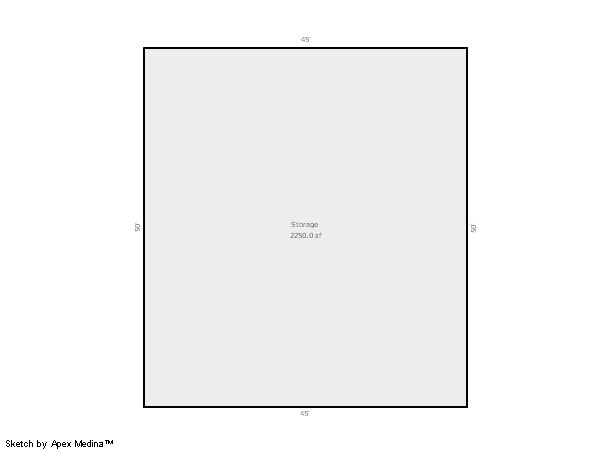

| 2023 | 1965 | Out Building | 2,250 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Barn | None | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $181,835 | $318,375 | - |

| Total Taxable Value (Capped) | $126,482 | $318,375 | - |

| Improvement Value | $176,600 | $315,000 | - |

| Land Value | $5,235 | $3,375 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $13,913 | $35,021 | - |

| Exemptions | -$1,000 | $0 | - |

| Net Assessed Value | $12,913 | $35,021 | - |

| School District | BA-3A | ||

| Tax Rate | 128.50 | 128.81 | 128.81 |

| Estimated taxes | $1,659 | $4,511 | - |

| Last Notice Date | 3/26/2024 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | Apply | |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 6/28/2023 | PARSONS, GARY A AND HELEN, TRUSTEES PARSONS FAMILY TRUST | PW LAND HOLDING LLC | $915,000 | Trustee's Deed | 2023051955 |

| 7/17/2000 | $0 | Quit Claim Deed | 2000300734 BK-06390PG-00496 | ||

| 4/5/1977 | HENDERSON, FRANK S & MABELENE M | PARSONS, GARY A & HELEN E | $0 | Warranty Deed | 2022107897 |

Sales/Documents

| Sale Date | 6/28/2023 |

|---|---|

| Grantor | PARSONS, GARY A AND HELEN, TRUSTEES PARSONS FAMILY TRUST |

| Grantee | PW LAND HOLDING LLC |

| Sale Price | $915,000 |

| Deed Type | Trustee's Deed |

| Document Number | 2023051955 |

| Sale Date | 7/17/2000 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2000300734 BK-06390PG-00496 |

| Sale Date | 4/5/1977 |

| Grantor | HENDERSON, FRANK S & MABELENE M |

| Grantee | PARSONS, GARY A & HELEN E |

| Sale Price | $0 |

| Deed Type | Warranty Deed |

| Document Number | 2022107897 |