General Information

| Situs Address | |

|---|---|

| Owner Name |

ROEDEL, RICHARD R & KRISTI D

|

| Owner Mailing Address | PO BOX 1370 SAND SPRINGS , OK 740631370 |

| Account Type | Agricultural |

| Parcel ID | 99028-90-28-63710 |

| Land Area | 3.61 acres / 157,200 sq ft |

| School District | 15B |

| Legal Description | Subdivision: UNPLATTED (99028) Legal: PRT W/2 SE BEG 1025E SWC W/2 SE TH N596 W175 N450 E250 S1046 W75 POB SEC 28 19 10 3.609ACS Section: 28 Township: 19 Range: 10 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

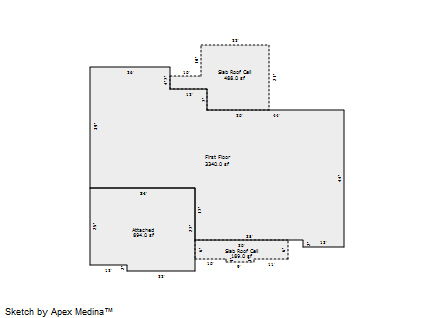

| 2025 | 2015 | Residential | 3,340 sqft | 1.00 | 8 | 3.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Brick/Stone Veneer | Cool Air in Heat Ducts | |||

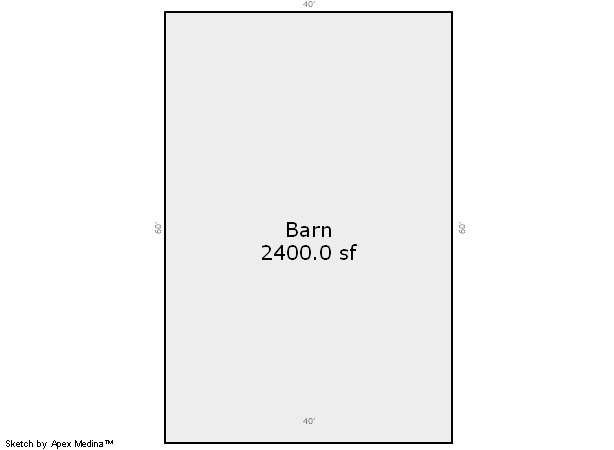

| 2025 | 2010 | Out Building | 2,400 sqft | 1.00 | 12 | 0.00 | |

| 2.00 | Equipment Building | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2015 | Residential | 3,340 sqft | 1.00 | 8 | 3.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Brick/Stone Veneer | Cool Air in Heat Ducts | |||

| 2024 | 2010 | Out Building | 2,400 sqft | 1.00 | 12 | 0.00 | |

| 2.00 | Equipment Building | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2015 | Residential | 3,340 sqft | 1.00 | 8 | 3.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Brick/Stone Veneer | Cool Air in Heat Ducts | |||

| 2023 | 2010 | Out Building | 2,400 sqft | 1.00 | 12 | 0.00 | |

| 2.00 | Equipment Building | None | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $320,277 | $320,277 | $337,249 |

| Total Taxable Value (Capped) | $320,277 | $320,277 | $329,886 |

| Improvement Value | $320,000 | $320,000 | $336,972 |

| Land Value | $277 | $277 | $277 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $35,230 | $35,230 | $36,288 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $35,230 | $35,230 | $36,288 |

| School District | 15B | ||

| Tax Rate | 92.10 | 91.18 | 91.18 |

| Estimated taxes | $3,245 | $3,212 | $3,309 |

| Last Notice Date | 3/25/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 12/16/2020 | LITKE, DEVIN E & ELIZABETH M | ROEDEL, RICHARD R & KRISTI D | $400,000 | Warranty Deed | 2020127361 |

| 10/7/2014 | LITKE, BRADLEY & LORINDA | LITKE, DEVIN E & ELIZABETH M | $0 | Quit Claim Deed | 2014089796 |

Sales/Documents

| Sale Date | 12/16/2020 |

|---|---|

| Grantor | LITKE, DEVIN E & ELIZABETH M |

| Grantee | ROEDEL, RICHARD R & KRISTI D |

| Sale Price | $400,000 |

| Deed Type | Warranty Deed |

| Document Number | 2020127361 |

| Sale Date | 10/7/2014 |

| Grantor | LITKE, BRADLEY & LORINDA |

| Grantee | LITKE, DEVIN E & ELIZABETH M |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2014089796 |