General Information

| Situs Address | 5801 S 265 AV W SAND SPRINGS 74063 |

|---|---|

| Owner Name |

IWG TOWERS ASSETS II LLC C/O RYAN LLC- PTS

|

| Owner Mailing Address | PO BOX 460389 HOUSTON , TX 77056 |

| Account Type | Comm Ag |

| Parcel ID | 99031-90-31-54810 |

| Land Area | 100.00 acres / 4,356,000 sq ft |

| School District | 15B |

| Legal Description | Subdivision: UNPLATTED (99031) Legal: BEG 396N SWC E/2 SEC TH N2904 E1500 S2904 W1500 TO POB SEC 31 19 10 100ACS Section: 31 Township: 19 Range: 10 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

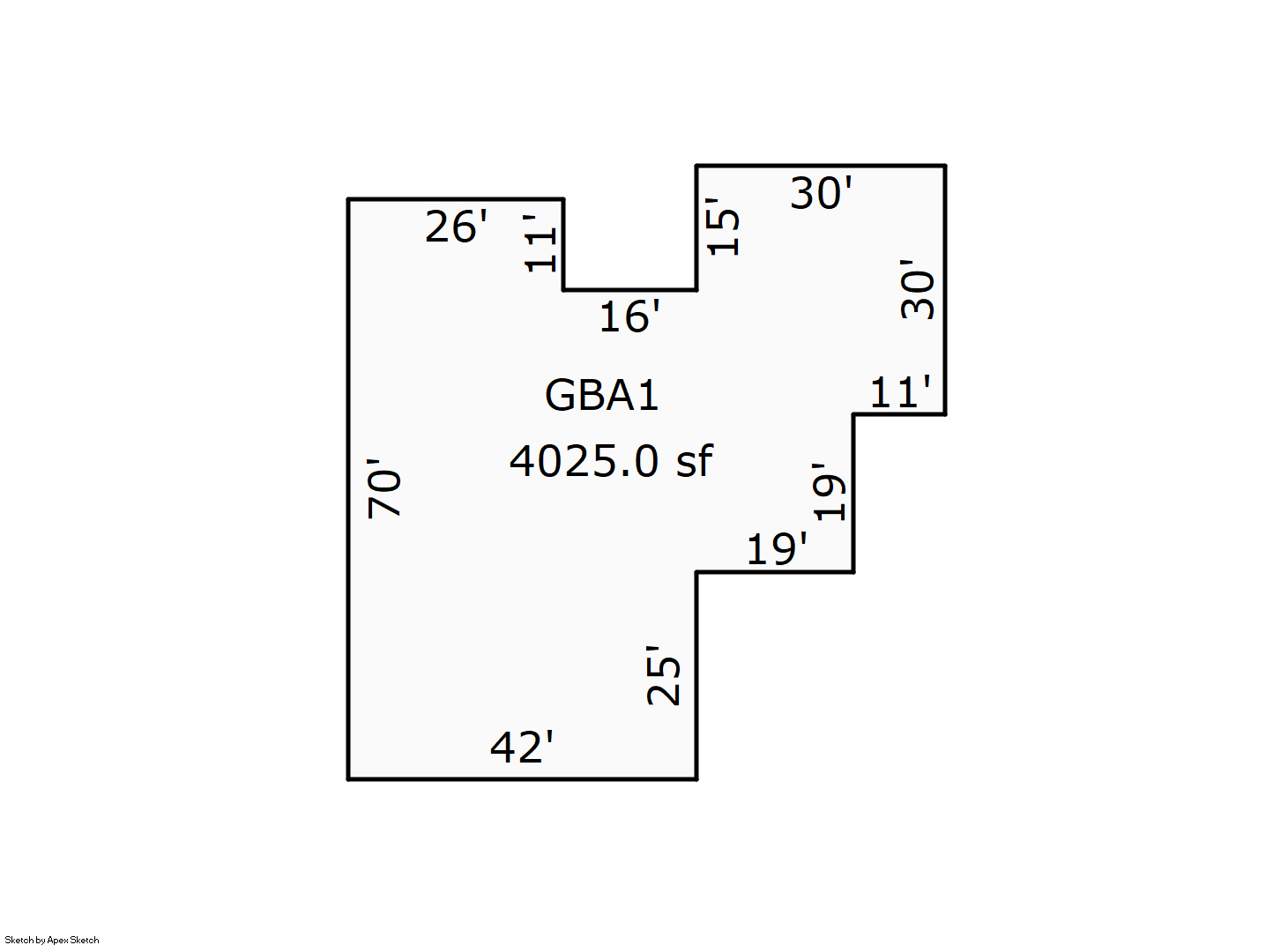

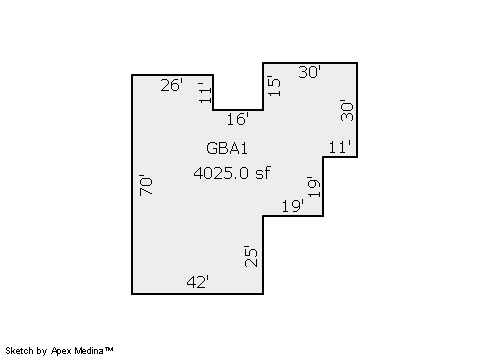

| 2025 | 1950 | Commercial | 4,025 sqft | 1.00 | 8 | 0.00 | |

| 1.00 | Radio & TV Stations | Forced Air | |||||

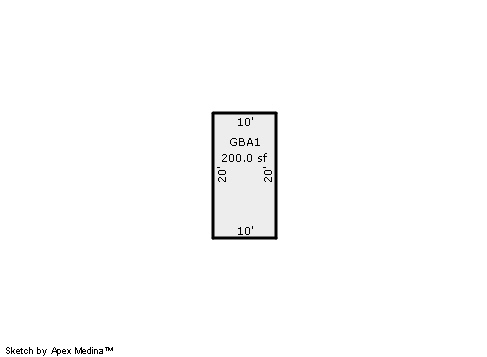

| 2025 | 2011 | Commercial | 200 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Radio & TV Stations | Forced Air | |||||

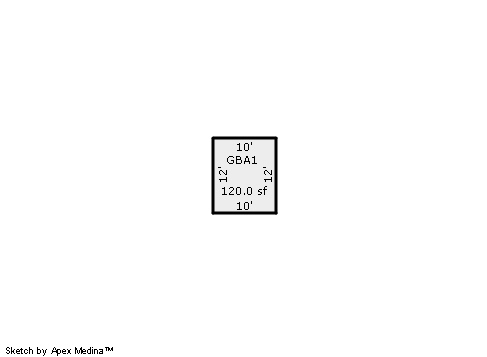

| 2025 | 2011 | Commercial | 120 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Radio & TV Stations | Forced Air | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1950 | Commercial | 4,025 sqft | 1.00 | 8 | 0.00 | |

| 1.00 | Radio & TV Stations | Forced Air | |||||

| 2024 | 2011 | Commercial | 200 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Radio & TV Stations | Forced Air | |||||

| 2024 | 2011 | Commercial | 120 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Radio & TV Stations | Forced Air | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1950 | Commercial | 4,025 sqft | 1.00 | 8 | 0.00 | |

| 1.00 | Radio & TV Stations | Forced Air | |||||

| 2023 | 2011 | Commercial | 200 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Radio & TV Stations | Forced Air | |||||

| 2023 | 2011 | Commercial | 120 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Radio & TV Stations | Forced Air | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $104,018 | $104,018 | $104,018 |

| Total Taxable Value (Capped) | $104,018 | $104,018 | $104,018 |

| Improvement Value | $89,200 | $89,200 | $89,200 |

| Land Value | $14,818 | $14,818 | $14,818 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $11,442 | $11,442 | $11,442 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $11,442 | $11,442 | $11,442 |

| School District | 15B | ||

| Tax Rate | 92.10 | 91.18 | 91.18 |

| Estimated taxes | $1,054 | $1,043 | $1,043 |

| Last Notice Date | 3/29/2023 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 7/15/2015 | NEW CITY COMMUNICATIONS OF TULSA INC | IWG TOWERS ASSETS II LLC | $104,000 | Special Warranty Deed | 2015079002 |

| 10/28/1993 | $0 | History | 2000302141 BK-05556PG-00847 |

Sales/Documents

| Sale Date | 7/15/2015 |

|---|---|

| Grantor | NEW CITY COMMUNICATIONS OF TULSA INC |

| Grantee | IWG TOWERS ASSETS II LLC |

| Sale Price | $104,000 |

| Deed Type | Special Warranty Deed |

| Document Number | 2015079002 |

| Sale Date | 10/28/1993 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | History |

| Document Number | 2000302141 BK-05556PG-00847 |