General Information

| Situs Address | 200 E MORROW RD S SAND SPRINGS 74063 |

|---|---|

| Owner Name |

VALUED PARTNERS INVESTMENTS LLC

|

| Owner Mailing Address | 4527 E 91ST ST TULSA , OK 741372810 |

| Account Type | Commercial |

| Parcel ID | 99114-91-14-28370 |

| Land Area | 3.93 acres / 171,060 sq ft |

| School District | SS-2A |

| Legal Description | Subdivision: UNPLATTED (99114) Legal: PRT N/2 NE BEG 1145.80E & 55S NWC NE TH E200 S262.50 E195.20 S300 W395.20 N562.50 POB SEC 14 19 11 3.927ACS Section: 14 Township: 19 Range: 11 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

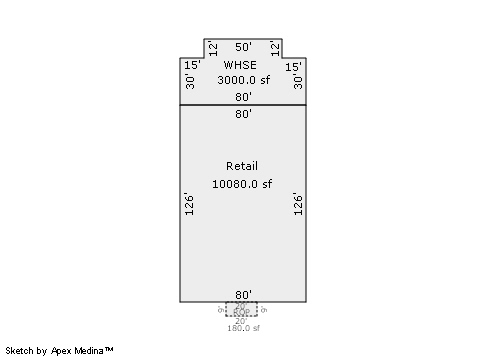

| 2025 | 1971 | Commercial | 13,080 sqft | 1.00 | 16 | 0.00 | |

| 1.00 | Storage Warehouse | Warm and Cool Air Zone | |||||

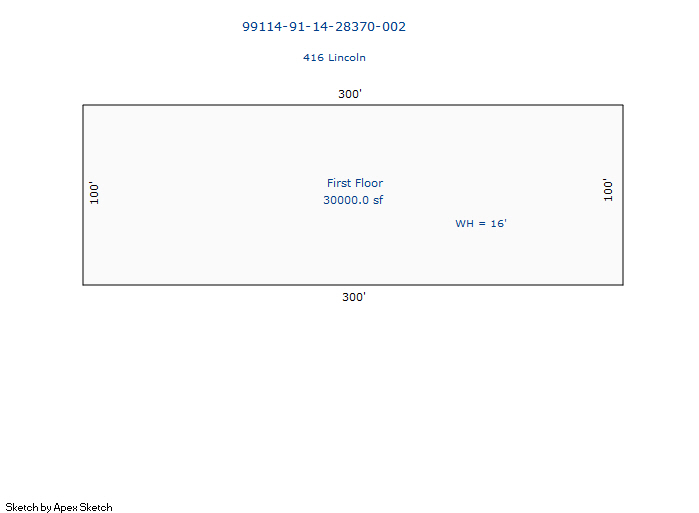

| 2025 | 2019 | Commercial | 30,000 sqft | 1.00 | 16 | 0 | |

| 2.00 | Industrial Flex Mall Building | None | |||||

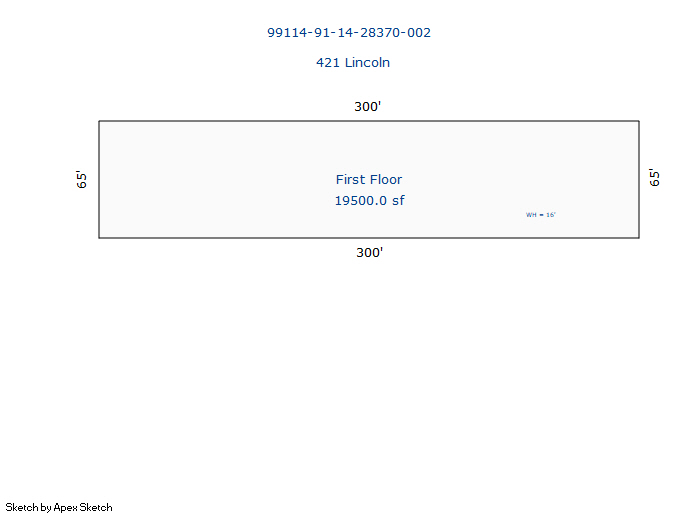

| 2025 | 2019 | Commercial | 19,500 sqft | 1.00 | 16 | 0 | |

| 3.00 | Industrial Flex Mall Building | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1971 | Commercial | 13,080 sqft | 1.00 | 16 | 0.00 | |

| 1.00 | Storage Warehouse | Warm and Cool Air Zone | |||||

| 2024 | 2019 | Commercial | 30,000 sqft | 1.00 | 16 | 0 | |

| 2.00 | Industrial Flex Mall Building | None | |||||

| 2024 | 2019 | Commercial | 19,500 sqft | 1.00 | 16 | 0 | |

| 3.00 | Industrial Flex Mall Building | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1971 | Commercial | 13,080 sqft | 1.00 | 16 | 0.00 | |

| 1.00 | Storage Warehouse | Warm and Cool Air Zone | |||||

| 2023 | 2019 | Commercial | 30,000 sqft | 1.00 | 16 | 0 | |

| 2.00 | Industrial Flex Mall Building | None | |||||

| 2023 | 2019 | Commercial | 19,500 sqft | 1.00 | 16 | 0 | |

| 3.00 | Industrial Flex Mall Building | None | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $4,812,100 | $5,046,800 | $4,559,000 |

| Total Taxable Value (Capped) | $4,341,865 | $4,558,959 | $4,559,000 |

| Improvement Value | $4,426,500 | $4,661,200 | $4,173,400 |

| Land Value | $385,600 | $385,600 | $385,600 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $477,605 | $501,486 | $501,490 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $477,605 | $501,486 | $501,490 |

| School District | SS-2A | ||

| Tax Rate | 126.21 | 127.61 | 127.61 |

| Estimated taxes | $60,279 | $63,995 | $63,995 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 7/18/2016 | MORROW GILL LUMBER COMPANY INC | VALUED PARTNERS INVESTMENTS LLC | $765,000 | General Warranty Deed | 2016067710 |

| 6/18/2016 | MORROW GILL LUMBER CO; CHENEY, CAROLYN MORROW ETAL | VALUED PARTNERS INVESTMENTS LLC | $135,000 | General Warranty Deed | 2016067711 |

Sales/Documents

| Sale Date | 7/18/2016 |

|---|---|

| Grantor | MORROW GILL LUMBER COMPANY INC |

| Grantee | VALUED PARTNERS INVESTMENTS LLC |

| Sale Price | $765,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2016067710 |

| Sale Date | 6/18/2016 |

| Grantor | MORROW GILL LUMBER CO; CHENEY, CAROLYN MORROW ETAL |

| Grantee | VALUED PARTNERS INVESTMENTS LLC |

| Sale Price | $135,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2016067711 |