General Information

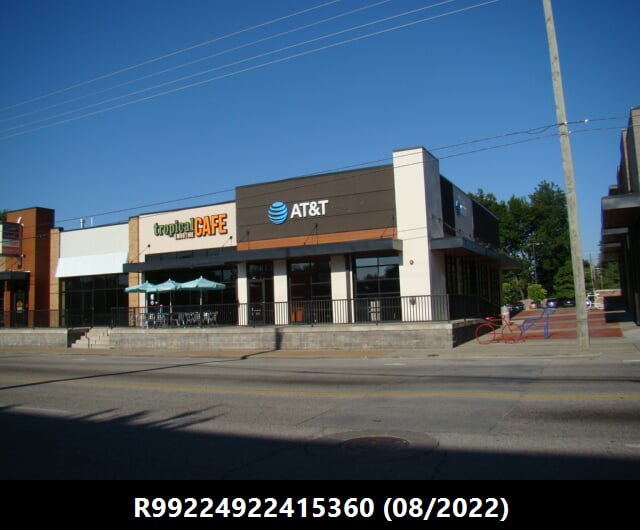

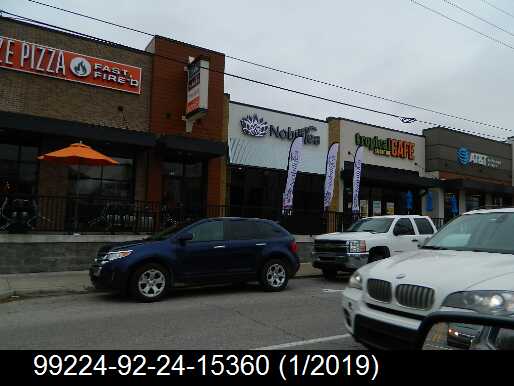

| Situs Address | 3702 S PEORIA AV E TULSA 74105 |

|---|---|

| Owner Name |

CH RETAIL FUND II/TULSA BROOKLAND NORTH LLC

|

| Owner Mailing Address | 521 E 2ND ST STE 701 TULSA , OK 741201857 |

| Account Type | Commercial |

| Parcel ID | 99224-92-24-15360 |

| Land Area | 1.51 acres / 65,800 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: UNPLATTED (99224) Legal: BEG 25S & 35W NEC SE NE SE TH S280 W145 N140 W180 N140 E325 POB SEC 24 19 12 1.51ACS Section: 24 Township: 19 Range: 12 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 2015 | Commercial | 12,100 sqft | 1.00 | 20 | 0 | |

| 1.00 | Market | Package Unit | |||||

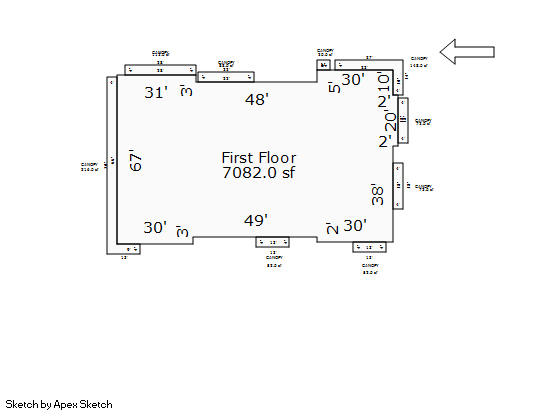

| 2025 | 2015 | Commercial | 7,082 sqft | 1.00 | 16 | 0 | |

| 2.00 | Neighborhood Shopping Center | Complete HVAC | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2015 | Commercial | 12,100 sqft | 1.00 | 20 | 0 | |

| 1.00 | Market | Package Unit | |||||

| 2024 | 2015 | Commercial | 7,082 sqft | 1.00 | 16 | 0 | |

| 2.00 | Neighborhood Shopping Center | Complete HVAC | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2015 | Commercial | 12,100 sqft | 1.00 | 20 | 0 | |

| 1.00 | Market | Package Unit | |||||

| 2023 | 2015 | Commercial | 7,082 sqft | 1.00 | 16 | 0 | |

| 2.00 | Neighborhood Shopping Center | Complete HVAC | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $8,689,500 | $8,689,500 | $8,509,600 |

| Total Taxable Value (Capped) | $8,689,500 | $8,689,500 | $8,509,600 |

| Improvement Value | $6,726,300 | $6,726,300 | $6,546,400 |

| Land Value | $1,963,200 | $1,963,200 | $1,963,200 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $955,845 | $955,845 | $936,056 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $955,845 | $955,845 | $936,056 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $121,306 | $123,791 | $121,229 |

| Last Notice Date | There is no recent notice date for this property | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 1/12/2018 | BROOKLAND NORTH LLC ETAL | CH RETAIL FUND II/TULSA BROOKLAND NORTH, LLC | $11,180,000 | Special Warranty Deed | 2018004078 |

| 2/16/2015 | BROOKLAND NORTH LLC | GRH PEORIA LLC & BCV PEORIA LLC & SRG PEORIA LLC | $1,228,500 | Special Warranty Deed | 2015022518 |

| 4/30/2008 | BOWMAN, REP FOR JENKINS MARY L | BROOKLAND NORTH LLC | $583,000 | Personal Representative's Deed | 2008044932 |

| 4/30/2008 | WILLOUGHBY, GRETCHEN BROCKMAN | BROOKLAND NORTH LLC | $583,500 | Special Warranty Deed | 2008044931 |

| 4/30/2008 | PITCOCK ELEANOR M TRUSTEE | BROOKLAND NORTH LLC | $583,500 | Special Warranty Deed | 2008044930 |

Sales/Documents

| Sale Date | 1/12/2018 |

|---|---|

| Grantor | BROOKLAND NORTH LLC ETAL |

| Grantee | CH RETAIL FUND II/TULSA BROOKLAND NORTH, LLC |

| Sale Price | $11,180,000 |

| Deed Type | Special Warranty Deed |

| Document Number | 2018004078 |

| Sale Date | 2/16/2015 |

| Grantor | BROOKLAND NORTH LLC |

| Grantee | GRH PEORIA LLC & BCV PEORIA LLC & SRG PEORIA LLC |

| Sale Price | $1,228,500 |

| Deed Type | Special Warranty Deed |

| Document Number | 2015022518 |

| Sale Date | 4/30/2008 |

| Grantor | BOWMAN, REP FOR JENKINS MARY L |

| Grantee | BROOKLAND NORTH LLC |

| Sale Price | $583,000 |

| Deed Type | Personal Representative's Deed |

| Document Number | 2008044932 |

| Sale Date | 4/30/2008 |

| Grantor | WILLOUGHBY, GRETCHEN BROCKMAN |

| Grantee | BROOKLAND NORTH LLC |

| Sale Price | $583,500 |

| Deed Type | Special Warranty Deed |

| Document Number | 2008044931 |

| Sale Date | 4/30/2008 |

| Grantor | PITCOCK ELEANOR M TRUSTEE |

| Grantee | BROOKLAND NORTH LLC |

| Sale Price | $583,500 |

| Deed Type | Special Warranty Deed |

| Document Number | 2008044930 |