General Information

| Situs Address | 4808 S ELWOOD AV W TULSA 74107 |

|---|---|

| Owner Name |

ROYCE CHERRY HILL LLC

|

| Owner Mailing Address | 80 S LAKE AVE STE 719 PASADENA , CA 911012638 |

| Account Type | Commercial |

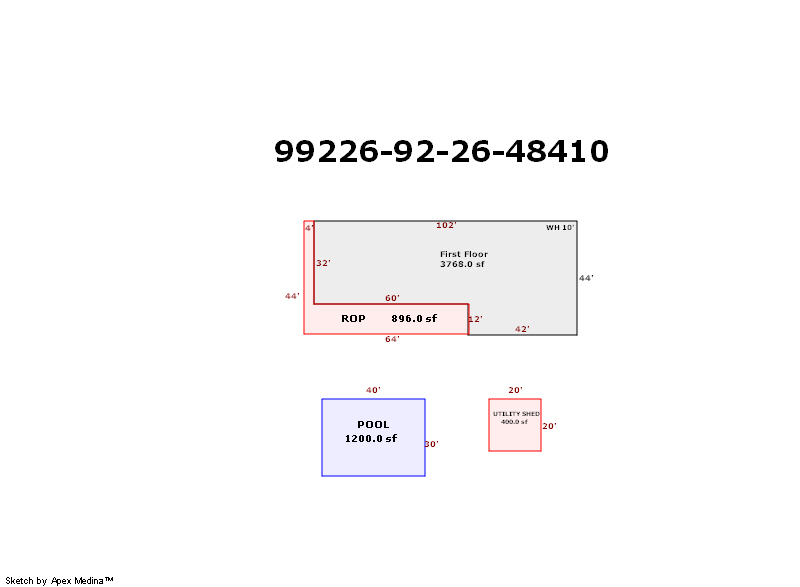

| Parcel ID | 99226-92-26-48410 |

| Land Area | 38.56 acres / 1,679,485 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: UNPLATTED (99226) Legal: PRT SE BEG NEC SE TH S948.62 W220 S476.93 SWLY97.23 NW392.97 SW489.19 NW1151.19 NW249.78 N189.47 E1985.70 POB LESS BEG 948.62S & 220W & 377.24S NEC SE TH W7.58 NWLY15.80 NWLY98.10 NW12.65 NW28.54 SW3.52 NW40.69 NE3.10 NW31.67 NW1.30 NW13.19 NW13.16 NW13.09 NW13.14 NW6.68 NW12.55 NW15.05 NW47.49 NW57.74 NW45.65 WLY46.67 NW24.31 WLY100 WLY66.34 W40.58 W22.13 WLY42.59 NW7.29 NW50.33 NW22.50 NW27.21 NW42.28 NW 7.37 NW46.63 NW 25.90 NW11.70 NW15.95 NW36.51 NW58.05 NW47.71 NW.97 NW11.34 NW13.30 NW13.15 NW13.30 NW26.37 NW39.54 NW12.82 NW71.93 NW150.20 NW99.90 NW100.22 NW100.07 NW15.43 NW65.66 NW14.59 NW14.79 NW13.72 NW14.52 NW30.36 NW41.02 NW49.69 NW11.36 NE4.51 NW203.09 S154.99 SE252.61 SE1151.19 NE489.19 SE392.97 ELY97.23 N102.22 POB SEC 26 19 12 38.555ACS Section: 26 Township: 19 Range: 12 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 1975 | Mobile Home | 3,768 sqft | 1.00 | 10 | 0.00 | |

| 1.00 | Clubhouse | Package Unit | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1975 | Mobile Home | 3,768 sqft | 1.00 | 10 | 0.00 | |

| 1.00 | Clubhouse | Package Unit | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1975 | Mobile Home | 3,768 sqft | 1.00 | 10 | 0.00 | |

| 1.00 | Clubhouse | Package Unit | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $9,528,500 | $9,528,500 | - |

| Total Taxable Value (Capped) | $9,528,500 | $9,528,500 | - |

| Improvement Value | $8,639,400 | $8,639,400 | - |

| Land Value | $889,100 | $889,100 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $1,048,135 | $1,048,135 | - |

| Exemptions | $0 | $0 | - |

| Net Assessed Value | $1,048,135 | $1,048,135 | - |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $133,019 | $135,744 | - |

| Last Notice Date | 2/2/2022 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 12/6/2021 | KENDALL TRUST & ETALS | ROYCE CHERRY HILL LLC | $0 | Warranty Deed | 2021144321 |

| 2/17/2021 | BOGGS, LOGAN A TRUST ETAL | ROYCE CHERRY HILL LLC | $9,563,500 | Special Warranty Deed | 2021101067 |

| 1/19/2011 | KENDALL, DWIGHT M ESTATE | KENDALL, DONA S TRUSTEE KENDALL FAMILY TR. | $0 | Decree Of Distribution | 2011010368 |

| 2/8/1995 | BOGGS, LOGAN A | BOGGS, LOGAN A TRUST | $0 | Quit Claim Deed | 1995016725 |

Sales/Documents

| Sale Date | 12/6/2021 |

|---|---|

| Grantor | KENDALL TRUST & ETALS |

| Grantee | ROYCE CHERRY HILL LLC |

| Sale Price | $0 |

| Deed Type | Warranty Deed |

| Document Number | 2021144321 |

| Sale Date | 2/17/2021 |

| Grantor | BOGGS, LOGAN A TRUST ETAL |

| Grantee | ROYCE CHERRY HILL LLC |

| Sale Price | $9,563,500 |

| Deed Type | Special Warranty Deed |

| Document Number | 2021101067 |

| Sale Date | 1/19/2011 |

| Grantor | KENDALL, DWIGHT M ESTATE |

| Grantee | KENDALL, DONA S TRUSTEE KENDALL FAMILY TR. |

| Sale Price | $0 |

| Deed Type | Decree Of Distribution |

| Document Number | 2011010368 |

| Sale Date | 2/8/1995 |

| Grantor | BOGGS, LOGAN A |

| Grantee | BOGGS, LOGAN A TRUST |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 1995016725 |