General Information

| Situs Address | 4843 S 81 AV W TULSA 74107 |

|---|---|

| Owner Name |

NEWBERRY, DANIEL B & LAURA

|

| Owner Mailing Address | 4843 S 81ST WEST AVE TULSA , OK 741078249 |

| Account Type | Agricultural |

| Parcel ID | 99230-92-30-08840 |

| Land Area | 2.50 acres / 108,899 sq ft |

| School District | 1B |

| Legal Description | Subdivision: UNPLATTED (99230) Legal: S171.06 N1364.54 W/2 GOV LTS 3 & 4 LESS W24.75 FOR RD SEC 30 19 12 2.50ACS Section: 30 Township: 19 Range: 12 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

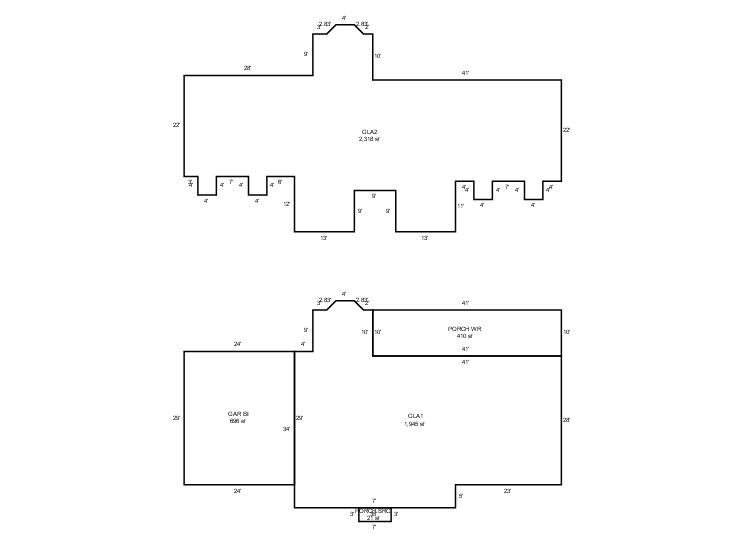

| 2025 | 2003 | Residential | 4,263 sqft | 2.00 | 8 | 2.10 | Composition Shingle |

| 1.00 | 2 Story | Slab | Frame Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2003 | Residential | 4,263 sqft | 2.00 | 8 | 2.10 | Composition Shingle |

| 1.00 | 2 Story | Slab | Frame Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2003 | Residential | 4,263 sqft | 2.00 | 8 | 2.10 | Composition Shingle |

| 1.00 | 2 Story | Slab | Frame Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $326,864 | $326,864 | $326,864 |

| Total Taxable Value (Capped) | $289,553 | $298,240 | $307,187 |

| Improvement Value | $326,600 | $326,600 | $326,600 |

| Land Value | $264 | $264 | $264 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $31,851 | $32,807 | $33,790 |

| Exemptions | -$1,000 | -$1,000 | -$1,000 |

| Net Assessed Value | $30,851 | $31,807 | $32,790 |

| School District | 1B | ||

| Tax Rate | 111.61 | 111.88 | 111.88 |

| Estimated taxes | $3,443 | $3,559 | $3,669 |

| Last Notice Date | 3/25/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | |||

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 3/7/2017 | MAZZEI, DANIEL AND MARY | NEWBERRY, DANIEL & LAURA | $404,000 | General Warranty Deed | 2017022637 |

| 1/4/2013 | NEWBERRY, DANIEL AND LAURA | MAZZEI, DANIEL AND MARY | $290,000 | General Warranty Deed | 2013003397 |

| 4/7/2000 | $0 | Warranty Deed | 2000304895 BK-06348PG-02678 |

Sales/Documents

| Sale Date | 3/7/2017 |

|---|---|

| Grantor | MAZZEI, DANIEL AND MARY |

| Grantee | NEWBERRY, DANIEL & LAURA |

| Sale Price | $404,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2017022637 |

| Sale Date | 1/4/2013 |

| Grantor | NEWBERRY, DANIEL AND LAURA |

| Grantee | MAZZEI, DANIEL AND MARY |

| Sale Price | $290,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2013003397 |

| Sale Date | 4/7/2000 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | Warranty Deed |

| Document Number | 2000304895 BK-06348PG-02678 |