General Information

| Situs Address | 5610 W SKELLY DR S TULSA 74107 |

|---|---|

| Owner Name |

FREESTAR INVESTMENTS LLC

|

| Owner Mailing Address | C/O BAUER & ASSOCIATES INC 6846 S CANTON AVE STE 100 TULSA, OK 741363413 |

| Account Type | Commercial |

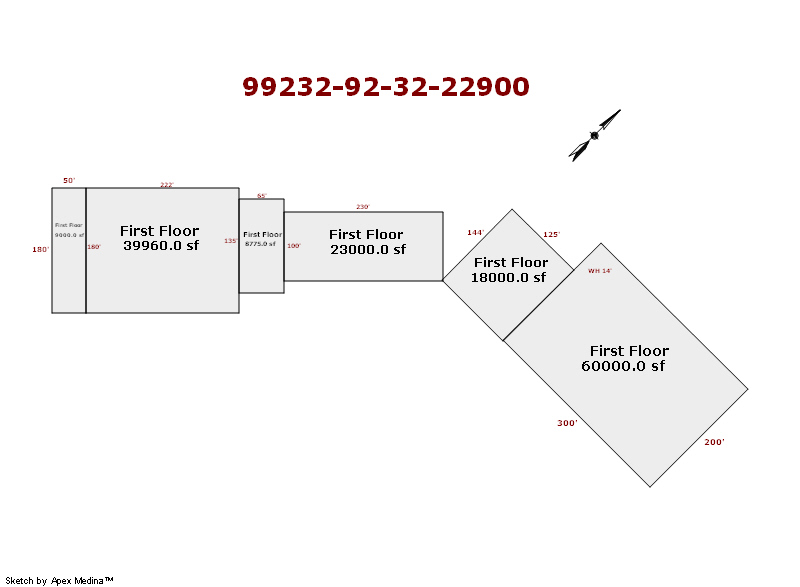

| Parcel ID | 99232-92-32-22900 |

| Land Area | 12.98 acres / 565,627 sq ft |

| School District | SA-1A |

| Legal Description | Subdivision: UNPLATTED (99232) Legal: PRT NE SE BEG NEC SE TH S365.92 W25 SW77.56 NW50 SW100 SE151.07 SW205 NW100 SW100 SE100 SW30 NW100 SW100 SE100 SW85 TH ON LF CRV 240.34 NW100 SW115 RT CRV 108.81 NW11.14 NE120 NW220 NE867.18 E450.65 POB SEC 32 19 12 12.76ACS Section: 32 Township: 19 Range: 12 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 1979 | Commercial | 158,735 sqft | 1.00 | 14 | 0.00 | |

| 1.00 | Community Shopping Center | Complete HVAC | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1979 | Commercial | 158,735 sqft | 1.00 | 14 | 0.00 | |

| 1.00 | Community Shopping Center | Complete HVAC | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1979 | Commercial | 158,735 sqft | 1.00 | 14 | 0.00 | |

| 1.00 | Community Shopping Center | Complete HVAC | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $4,056,000 | $4,056,000 | - |

| Total Taxable Value (Capped) | $4,056,000 | $4,056,000 | - |

| Improvement Value | $2,924,700 | $2,924,700 | - |

| Land Value | $1,131,300 | $1,131,300 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $446,160 | $446,160 | - |

| Exemptions | $0 | $0 | - |

| Net Assessed Value | $446,160 | $446,160 | - |

| School District | SA-1A | ||

| Tax Rate | 129.27 | 128.98 | 128.98 |

| Estimated taxes | $57,675 | $57,546 | - |

| Last Notice Date | There is no recent notice date for this property | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 8/15/2017 | TOWN WEST LP | FREESTAR INVESTMENTS LLC | $4,100,000 | Special Warranty Deed | 2017075641 |

| 12/5/1997 | HARDESTY FLOYD R & DONNA | TOWN WEST LTD PARTNERSHIP | $2,950,000 | History | 2000305083 BK-05987PG-00245 |

Sales/Documents

| Sale Date | 8/15/2017 |

|---|---|

| Grantor | TOWN WEST LP |

| Grantee | FREESTAR INVESTMENTS LLC |

| Sale Price | $4,100,000 |

| Deed Type | Special Warranty Deed |

| Document Number | 2017075641 |

| Sale Date | 12/5/1997 |

| Grantor | HARDESTY FLOYD R & DONNA |

| Grantee | TOWN WEST LTD PARTNERSHIP |

| Sale Price | $2,950,000 |

| Deed Type | History |

| Document Number | 2000305083 BK-05987PG-00245 |