Exempt

This property is Exempt Commercial

R99235923522440

1030 W 51 ST S TULSA 741078327

$58

$6

General Information

| Situs Address | 1030 W 51 ST S TULSA 741078327 |

|---|---|

| Owner Name |

STATE OF OKLAHOMA

|

| Owner Mailing Address | 200 N E 21ST ST ROOM 3C7 OKLAHOMA CITY , OK 73105 |

| Account Type | Exempt Com |

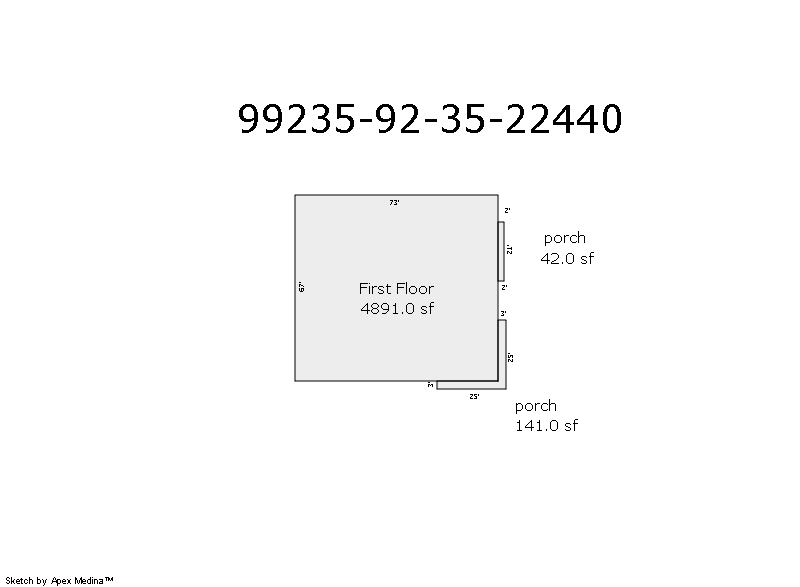

| Parcel ID | 99235-92-35-22440 |

| Land Area | 0.78 acres / 33,996 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: UNPLATTED (99235) Legal: PRT NE NW BEG 198W NEC NW TH S276 W77 N11 W121 N265 E198 POB LESS BEG 396W & 169.03S NEC NW TH S95.97 E121 S11 E77 N56 W94.66 NW115.75 POB & LESS N35 THEREOF FOR ST SEC 35 19 12 0.78AC Section: 35 Township: 19 Range: 12 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 1953 | Commercial | 4,891 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Fraternal Building | Complete HVAC | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1953 | Commercial | 4,891 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Fraternal Building | Complete HVAC | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1953 | Commercial | 4,891 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Fraternal Building | Complete HVAC | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $58 | $58 | - |

| Total Taxable Value (Capped) | $58 | $57 | - |

| Improvement Value | $0 | $0 | - |

| Land Value | $58 | $58 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $6 | $6 | - |

| Exemptions | $0 | $0 | - |

| Net Assessed Value | $6 | $6 | - |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $1 | $1 | - |

| Last Notice Date | There is no recent notice date for this property | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 6/10/2022 | RED FORK-BROOKSIDE MASONIC LODGE #505 A F & A M INC | STATE OF OKLAHOMA | $0 | Warranty Deed | 2022076746 |

| 4/25/2022 | RED FORK LODGE NO 505 | RED FORK-BROOKSIDE MASONIC | $0 | Quit Claim Deed | 2022044087 |

Sales/Documents

| Sale Date | 6/10/2022 |

|---|---|

| Grantor | RED FORK-BROOKSIDE MASONIC LODGE #505 A F & A M INC |

| Grantee | STATE OF OKLAHOMA |

| Sale Price | $0 |

| Deed Type | Warranty Deed |

| Document Number | 2022076746 |

| Sale Date | 4/25/2022 |

| Grantor | RED FORK LODGE NO 505 |

| Grantee | RED FORK-BROOKSIDE MASONIC |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2022044087 |